BoG to review compensation of bank CEOs in line with their banks performance

The Bank of Ghana (BoG) will begin scrutinising the compensation packages of chief executive officers (CEOs) and key management personnel of banks in a bid to ensure that the banks’ operational costs are not passed on to customers.

Close scrutiny is also expected to be applied to the remuneration of bank directors.

Advertisement

These are part of a raft of measures to align compensation packages to the overall performance of the banks.

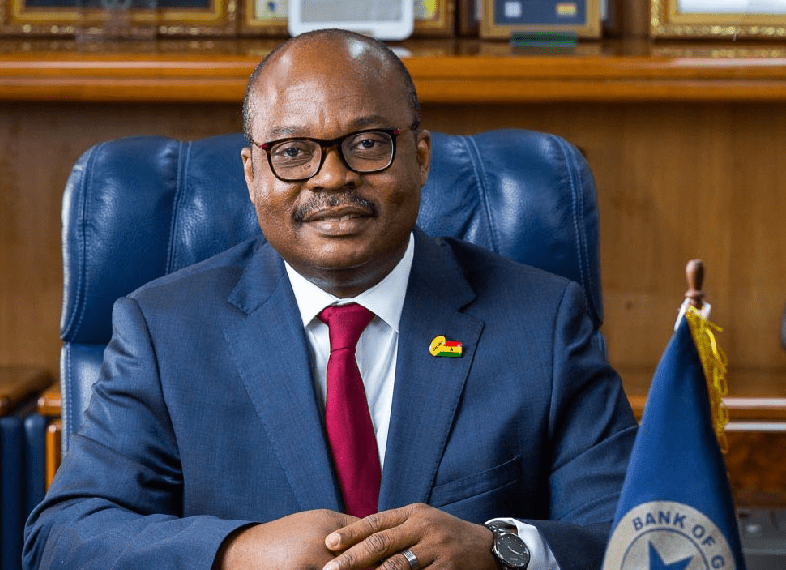

The Governor of the Bank of Ghana (BoG), Dr Ernest Addison, who announced this at the 91st Monetary Policy Committee (MPC) news conference in Accra on Monday, indicated that the measures would help foster more competition in the banking sector, and that would help bring down lending rates, which presently hover between 24 and 27 per cent.

“We will be working closely with the banks to ensure that they do not pass on their operational inefficiencies and overhead costs to their clients,” he said.

Operating cost

The banking industry’s cost in relation to its income has consistently remained around 50 per cent for the past four years.

Currently, the CEOs of the top-tier banks in the country earn between GH₵874,000 and GH₵1.3 million per annum, and financial watchers say this contributes to inefficiencies, resulting in the high operating costs of the banks, which are passed on through high interest rates to their clients.

To address this problem, Dr Addison said, compensation packages of the top management of the banks would henceforth not be in excess of the overall results that they put out.

He said the overall performance of the banks would be linked to clear parameters that included the quality of their assets to determine the remuneration of top management executives.

The MPC maintained the policy rate at 16 per cent as a result of some threats to the country’s economic growth and inflationary outlook.

Read also

Banking sector clean-up: Receivers recover only GH¢1bn

IMF endorses BoG approach to banking sector reforms

Banking sector clean-up saved a million depositors - President Akufo-Addo

Impact on cost of credit

The policy rate is seen as the rate at which the Bank of Ghana lends to universal banks in the country.

Therefore, the decision to hold it at 16 per cent could impact positively on the cost of credit in the coming months.

“In view of the committee’s assessment, risks to the inflationary outlook were broadly balanced; therefore, it decided to maintain the policy rate at 16 per cent, while monitoring developments, going forward,” Dr Addison said.

He explained that the MPC noted the synchronised growth slowdown across advanced economies and its potential spillover effects on emerging markets and developing countries, saying that contributed to the maintenance.

The Governor explained that in addition to the assessment of macroeconomic conditions, the MPC undertook a deep review of the banking sector’s lending practices.

“Following the recapitalisation of banks, a rebound and gradual pick-up in the credit extension by banks is taking place,” he noted.

Stronger credit

He explained that to give impetus to stronger credit growth and facilitate the deepening of financial intermediation, the MPC sought to better understand the factors that limited access to credit and inhibited the monetary policy transmission process and the reasons for the high lending rates of universal banks.

He recounted that those factors had, over the years, acted to limit access to credit, keep cost of credit high to households and businesses and pose challenges to the attainment of higher economic growth.

However, the new measure would help reduce the cost of credit for small businesses in the country, he said.

Dr Addison indicated that the cedi's sharp depreciation had slowed over the past months.