Understanding digital financial services

All over the world, there are over 2.5 billion adults who do not have access to banking and financial services effectively excluding them from the formal economy, and making them unable to extricate themselves from the poverty cycle.

Digital financial services (DFS) can drastically transform the lives of many of the World’s poor and present an opportunity for including unbanked populations without them having to access traditional banking and financial infrastructure as we know it.

Advertisement

Digital financial services can be described as an array of financial services, which are offered and delivered through digital means, including savings, insurance, payments, credits to remittances.

Increasingly, we are recording mobile financial services (MFS) as one of the dominant digital channels in the digital financial services ecosystem.

One critical advantage of digital financial service is its ability to drastically cut the cost for the client as well as the service provider.

How does it work?

The core of digital financial services is a heavy dependence on new digital technologies to provide services to unbanked population.

It relies on alternative distribution channels (ADC) enabled by digital technologies.

In practice we can name online or internet banking, electronically enabled cards, Point of Sales (POS) devices, tablets, biometric devices, automated teller machines (ATMs), near-field communications (NFC)-enabled devices, mobile apps, mobile phones (feature phones and smartphones) as well as other digital agent networks all combine to provide on the go financial service and ensure that end users can consume financial services without setting a foot in a traditional bank.

There are three essential components of digital financial services; a digital transactions platform, retail agents and devices.

Typically, a customer can connect electronically to the platform directly or indirectly using third party intermediaries and an appropriate device to perform a myriad of financial services.

A combination of software and hardware and related systems enable clients to perform transactions on devices such as making or receiving payments, transfers or store value if connected to a regulator approved bank or non-banking system.

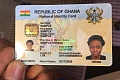

The Digital transactional platform comes with a number of capabilities such as payment systems, which enable transactions between clients and related parties, voice and data communication network and identity systems. Some DFS systems support the use of biometrics as part of an authentication system which recognises and validates identities using biometric data.

Another key component of digital financial services system is an electronic device such as POS, mobile or tablet, which serves as the interface for transactions. Such devices connected to communication networks enable financial and client data to be transmitted electronically during transactions.

Retail agents are also a very important component of the digital financial services ecosystem, they provide services to clients using digital services, you can think of them as a teller in the bank.

Digital financial services provide advantages such as easier access to formal financial services using electronic means, lower costs of transaction, reduced risk of loss, theft occasioned by cash-based transactions and increasing savings culture which can support access to credit facilities in the long run.

On the flip side, digital financial services can pose challenges such as novelty risk where end users with low digital literacy are not able to independently access digital financial services, so have to rely on third parties who they have to share account passwords with; an unsafe practice.

Furthermore some agents in the digital financial value chain, may not operate under any customer care standards therefore clients are not given the best of services and often do not have any formal complaint mechanism in place when they have challenges with these agents.

Lastly since digital financial services rely heavily on technology, any disruption of the network or damage to device will mean clients are not able to access services.

There is a need to strengthen the Digital Financial Services ecosystem which is made up of users, businesses, government agencies and non-profit groups; the providers (banks, other licensed financial institutions, and non-banks), supporting parties such as technology and other infrastructure providers such as mobile phone companies and regulatory bodies, by effectively co-ordinating activities to ensure they can all work seamlessly together.

Using new digital technology, especially mobile phones, presents a huge opportunity to offer cost effective financial services to millions of persons who are excluded from the formal financial services sector.

It means this previously unbanked population can now access financial services through digital channels providing them with opportunities for wealth creation.

Although digital financial services can not solve all the issues related to making the economy more cash-light, it presents a huge potential to transform our predominate informal economy to a more formal one and thus increase economic growth and sustainable development of our country.

The writer is the Director of Innovations at Penplusbytes.org e-mail: [email protected] WhatsApp : 0241995737