Reduce tax exemptions to increase revenues – Economists to govt

Economists at the University of Ghana have called on the government to be bold and take difficult decisions to unlock the potential of the economy.

Academics and research fellows at the Institute of Statistical, Social and Economic Research (ISSER) of the university said the outlook of the Ghanaian economy was bright, but difficult decisions such as slashing tax exemptions, increasing tax revenues and targeting social interventions better would propel the economy into higher performance.

Advertisement

“Import exemptions from international trade fell to 24.8 per cent and 19.2 per cent of total revenue in 2016 and 2017 respectively, but in 2018, exemptions on imports increased to 33.6 per cent of total revenue from international trade, translating into GH¢2.047 billion out of GH¢6.102 billion realised from international trade taxes,” they said when they presented the latest State of the Ghanaian Economy Report at the institute in Accra yesterday.

The report indicated that the contribution of international trade taxes to total tax revenue fell from 17 per cent in 2017 to 16.2 per cent in 2018.

The Director of ISSER, Professor Peter Quartey, who led the team of experts to present the report, stressed that the time had come for the government to prioritise domestic revenue mobilisation and be disciplined in expenditure to firm up the hope of a robust economy.

In particular, he underscored the need for a critical review of the tax exemption regimes to rake in the needed resources for national development.

Fiscals

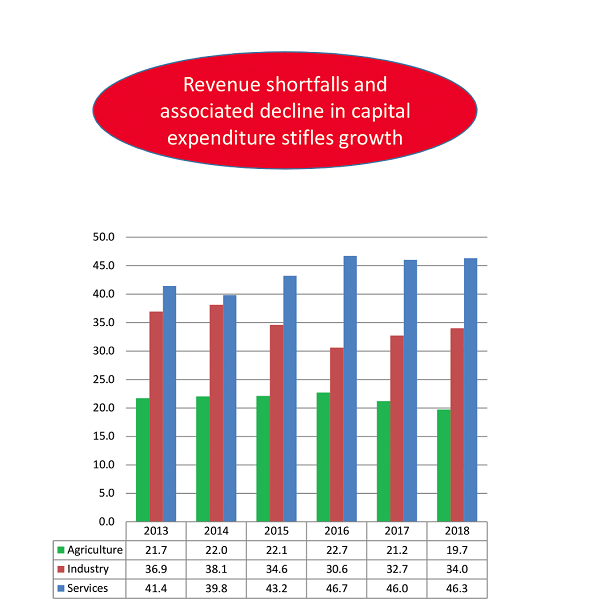

The report indicated that the economic growth declined in real gross domestic product (GDP) terms from 8.1 per cent in 2017 to 6.3 per cent in 2018 and was further expected to close the year with about 6.1 per cent, although it was projected to grow by 7.6 per cent.

Additionally, the ISSER report said tax exemptions estimated at GH¢4.2 billion for this year were too high and called on the government to take urgent steps to reduce them to shore up revenues and free up fiscal space.

In view of the increase in import tax exemptions from international trade, Prof. Quartey said: “There are other domestic tax exemptions and we suggest that there is the need to rationalise tax exemptions regime and make information public.”

The Director of ISSER said the outlook for 2019 looked promising though there were challenges. “Significant amounts of capital spending have been sacrificed and it is important that some fiscal space is created for capital spending,” he said.

Prof. Quartey stressed the need to improve non-tax revenue, including revenue from state-owned enterprises (SOEs) and property taxes.

He also called on the State Interest and Governance Authority to lead the way to ensure that the remuneration of chief executive officers of SOEs was tied to their competence and performance to ensure value for money.

Agriculture

The report indicated that agriculture was the only sector that made marginal progress as of June, this year as it grew from 2.2 per cent in the first quarter to 3.1 in the second quarter of the year.

Prof. Quartey attributed the improved performance of the sector partly to the Planting for Food and Jobs (PFJ) policy, but stressed that the over-reliance on donor support in the agricultural sector raised sustainability questions.

“The PFJ programme remained the flagship initiative for Ghana’s agriculture sector, and was expanded in 2018, accounting for the marginal increase in the performance of the sector in this year’s mid-year review.

“However, in 2018, projected contribution of development partner funds to total expenditure allocated to Ministry of Food and Agriculture was about 22 per cent and 2019 projections are even higher. The sector’s growth depends on the magnanimity of donors and this should be reconsidered,” he stated.

He stressed that agriculture was key in the government’s Ghana Beyond Aid agenda for which reason it was important to prioritise investment in the road infrastructure in farming areas.

Industry

The ISSER report said last year, the industrial sector outperformed both the agricultural and services sectors, although its growth fell from 15.7 per cent in 2017 to 10.6 per cent in 2018.

Prof. Quartey attributed the growth of the sector in 2018 largely to a general expansion in the mining and quarrying sub-sector, adding that the growth was projected at 9.7 per cent in 2019.

“The mining and quarrying sub-sector grew by 23.3 per cent, and accounted for 13.6 per cent of GDP in 2018 while the construction sub-sector grew by only 1.1 per cent, down from 5.1 per cent in 2017,” he said.

He said the sector had a better outlook because of improved macroeconomic stability which would benefit industrial sector growth.

“The reforms in the banking industry will in the medium term also benefit the sector while increased preference for Ghana as a destination for investment will also be a motivating factor,” he said.

Additionally, he said, the International Monetary Fund’s forecast of steady oil price could stimulate investment in the oil sub-sector.

“The lifting of the ban on small-scale mining and an expected capital injection by AngloGold Ashanti will increase gold production while there is the potential for expansion in manufacturing output from the one district, one factory projects,” he added.

The report also said the manufacturing sub-sector grew by 4.1 per cent in 2018, down from a growth of 7.9 per cent and 9.5 per cent in 2016 and 2017 respectively, with the electricity sub-sector recording a growth rate of 5.5 per cent in 2018 after a very high growth of 19.4 per cent in 2017.

For the services sector, he said, it declined from 4.3 per cent in 2017 to 2.7 per cent in 2018 as against the target of 5.1 per cent.

“Six sub-sectors, including trade, repair of vehicles, household goods; transport and storage; financial and insurance activities; business, real estate, and others; public administration and defence, social security, community, social and personal service activities performed below the targets set for 2018,” he said.

He added that only information and communications technology (ICT), health and social work sectors had double-digit figures of 10.7 per cent and 14.4 respectively.

Prudence

For his part, a senior research fellow at ISSER, Prof. Charles G. Ackah, who presented the Mid-year Review Report, stressed that the government needed to cut down its expenditure by reviewing some of its flagship and social intervention programmes.

He also called for a national discourse on the relevance of some ministries that were created by the government, saying the large numbers were a burden on the public purse.

For instance, he said, he did not see the essence of maintaining ministries such as the Inner City and Zongo Development, Business Development, Special Development Initiatives, and Monitoring and Evaluation.