A compelling case to list Agriculture Development Bank (ADB)

ADB’s decision to list on the Ghana Stock Exchange (GSE) has triggered a boom let of public criticism and mass despair, especially from its own workers union.

Advertisement

The mass berating meted out to Board members for their harmless intention to list this great company seems to have temporarily stalled the process. However, this temporal stalemate has given policy makers and industry pundits, with differing views, opportunity to argue their case out to the general populace, with the sole objective of garnering public sympathy for their chosen stance.

Even though enough have been done in convincing the general populace about the immense benefit of listing a company, however, little of such education has been buttress with solid historical data and this article sort to provide exactly that.

As a financial analyst, with a reputable investment banking firm in Ghana, I feel a deep sense of obligation to aid the general public, industry experts and policy makers in making financially sound decisions that can withstand posterity.

The famous quote from George Santayana states that “those who forget to learn about the past are condemned to repeat it”, this quote highlights the importance of learning from the past in order to effectively deal with some historical re-occurring glitches. Therefore this article takes insightful cues from historical parameters in arriving at a decision to list ADB bank.

ADB won’t be the first state bank to list, and I believe it won’t be the last too. Therefore for a compelling case to be made, about listing ADB, we will have to resort to historical performance data of listed state banks and non-listed state banks to ascertain which way offers that best return for stakeholders (State, customers, employees and the community).

For purposes of this article, we classified state owned banks to include all banks that Government of Ghana holds a direct majority stake (through the ministry of finance or BoG) or an indirect majority stake through SSNIT and other state owned enterprises. In reference to the above defined parameter, GCB and CAL bank were classified as “listed State Banks” while ADB and NIB qualified as “non-listed state banks”.

The analysis assessed the historical trend of indicators that measures financial strength, profitability, growth and value creation. These metrics were calculated for each of the banks and the average used to represent its category. This means that if ADB had a return of equity of 30% and NIB cloaked 30% for the same matric in a given year, then the average ROE for that year will be 30%.

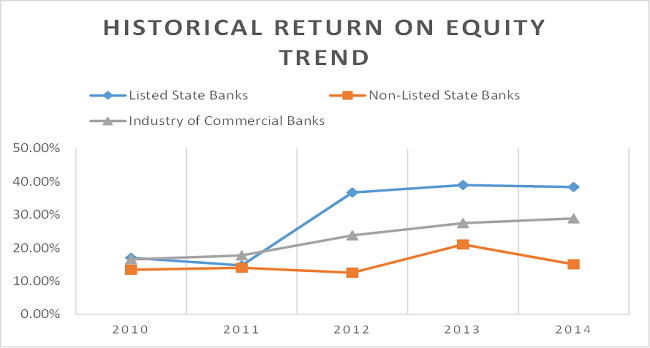

To measure profitability, the generic metric which is the return on equity was used and its five years historical trend for each group determined. The ROE for the listed state banks to the non-listed state banks can clearly be seen in the table below.

The data clearly shows that state-listed banks have consistently returned higher earning on every cedi of equity capital invested in them. The superior return on equity for state listed banks have constantly outstripped the average for the commercial banking industry since 2011 and seems likely to sustain this current pace. It’s further clear from the data that the non-listed state banks have underperformed the banking industry’s average for five years in a row.

The most alarming signal is that these non-listed state owned banks average ROE lags behinds its cost of equity as evident from the graph. For example, the average return on equity for year-end 2014, which was 15% trails average inflation and Treasury bill rate for that year.

This is destructive and can engender an unfavorable recapitalization program if measure are not instituted to curb the under-performance.

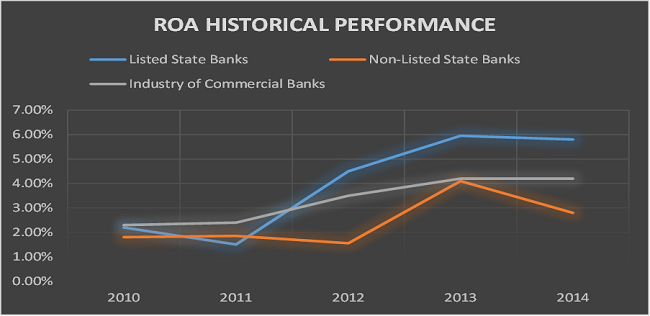

To fully understand the developing trend, a second measure of profitability was utilized. The return on asset which eliminates leverage or debt effect in measuring profitability was used. From the data compiled, ROA for listed banks showed superior performance than non-listed state owned banks.

This means that listed state owned banks tend to be more profitable in creating more profit form a cedi of asset given. From the diagram, ROA for state listed banks have consistently been superior than non-listed state owned banks and the entire industry of commercial banks.

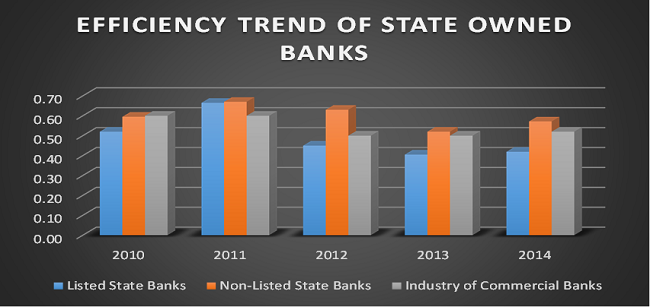

The other measure that was used to assess the group’s performance was their operational efficiency. Operational efficiency is a key parameter for measuring management’s ability to control cost and churn more profit out of a given amount of revenue.

The other measure that was used to assess the group’s performance was their operational efficiency. Operational efficiency is a key parameter for measuring management’s ability to control cost and churn more profit out of a given amount of revenue.

When a bank is efficient, it can reduce rate on loans/advance or increase depositor’s rates. All these can place the bank in a competitive position and help it garner enormous market shares in the long run.

In light of this advantage, which can be gleaned from efficiency, the efficiency ratio (cost-income ratio) was used to understand which group of bank is adept at cost mitigation.

The data further reinforced the prowess of listed government banks prudent cost management abilities. The cost mitigation strategies for listed state banks have been far superior to non-listed banks, further reinforcing the advantage of listing state banks.

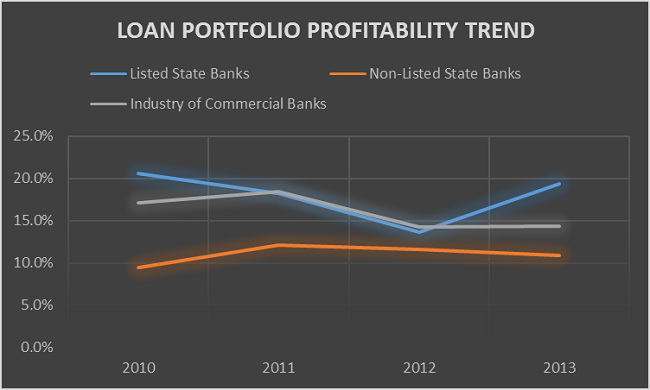

To finalize the research, the loan portfolio strength of both listed and non-listed state banks were observed. The observed trend showed a superior loan portfolio for listed state banks than non-listed state banks. From the loan portfolio profitability table below, the performance of listed state bank’s loan portfolio has shown higher profitability, lending credence to their superior credit process than non-listed state banks. Even though listed bank’s loan portfolio profitability trailed the industry’s portfolio profitability in 2012, it rebound marvelously in 2013 to recover its first position.

Why the superior performance

The superior performance of listed state banks can be attributed to the intense scrutiny and coverage a listed bank enjoys. The strict quarterly reporting of listed equities enables analyst and management to immediately identify developing negative trend with ease and propose prudent measures to salvage it. The myriad of analyst from renowned investment and brokerage houses, who covers these listed equities, provide free consultancy in a form of investment research and industry publications on the listed banks which aids management in making sound decision.

Furthermore, the existence of a vibrant stock market enables management to easily quantify the repercussions of their board and management room decisions by observing the impact on the share price. All these ensure a superior performance in the long run. I believe the advantage glean from listing far outweighs the opposite of not listing, this is evident in the fact that the average performance of these listed state banks performed higher than the entire commercial banking sector for straight five years(because less than 30% of commercial banks are listed).

Therefore I will urge all stakeholders to reconsider their thoughts and give listing this great bank a smooth go ahead. Thank you.

The writer is a Corporate Finance Analyst. Email: [email protected]