Economy entrapped by debts - Debt stock more than doubles in 3.5yrs

Ghana has taken on more debts in the past three-and-a-half years than it had done in 59 years.

The spike in borrowings in recent times has caused the national debt stock to hit a grim milestone of GH¢258.4 billion in June this year – more than double (111.8 per cent) of the national debt stock as of December 2016 (GH¢122 billion).

Combined with other fiscal slippages, the increased borrowing has boxed the country into a stuffy corner that now requires that more than three quarters of total revenue and grants are used to service the interest and pay down the principals.

The development has also complicated the fiscal rigidities bedeviling the economy, resulting in many experts and think tanks concluding that the country could only turn the tide when its debts were forgiven – similar to what happened under the Highly Indebted Poor Countries (HIPC) and Multilateral Debt Relief Initiative (MDRI) programme in 2002.

Debt entrapment

The grievous nature of the national debt stock in recent times is the result of stagnation in revenues and grants within the period.

Data from the Ministry of Finance showed that while annual revenue growth averaged about 19 per cent per cent prior to 2017, it fell to around 12.6 between 2017 and 2020.

In response, the government boosted its appetite for debt to be able to fund audacious campaign promises and rising non-discretionary expenditures.

Broadly, this has now entrapped the economy into a debt web that ensures that new loans are taken to retire old ones, thereby entrenching and compounding the burden.

In its analysis of the 2020 Mid-Year Budget Review, policy think tank, the Institute for Fiscal Policy (IFS), said borrowing was no longer a choice but an imposition.

“By the end of 2019, the country had clearly fallen into a debt trap, since borrowing was no more a choice but an imposition by the fiscal state of the country,” it said.

The institute expressed the fear that the situation would worsen in the coming months, as COVID-19-inspired borrowings trickled in.

Debt not bad

While expressing concern about the status of the country’s indebtedness, a Professor of Economics, Prof. Peter Quartey, told the Graphic Business on August 13 that borrowing in itself was not bad, provided the proceeds were invested efficiently and into productive ventures.

“We have seen Terminal Three (at Kotoka International Airport) and other projects, which are fruits of loans that we could not have put up but for borrowing.”

“But when you do not invest the borrowed funds well, that is when you get into a cycle by continuing to borrow to pay the old debts,” Prof. Quartey, who is the Director of the Institute for Statistical, Social and Economic Research (ISSER), said.

Debt distress

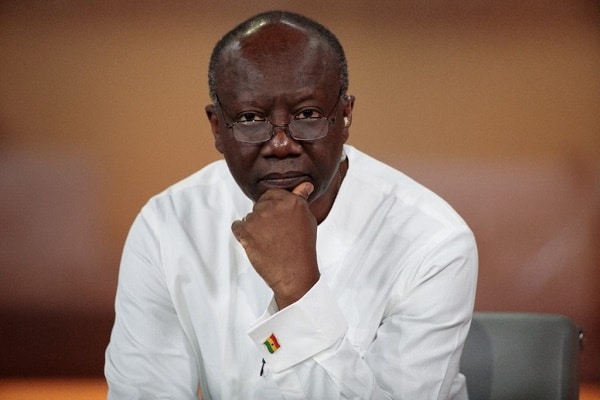

Since 2015, a joint Debt Sustainability Analysis (DSA) by the International Monetary Fund (IMF) and the World Bank Group (WBG) has consistently rated Ghana as a high-risk debt distress country, a tag the current administration fiercely finds distasteful. After issuing his second Eurobond in May 2018, the Finance Minister, Mr Ken Ofori-Atta, told investors that the government's focus was to achieve debt sustainability for the country.

To track progress to that commitment, Mr Ofori-Atta said: "Interest charges as a per centage of revenue becomes our core working targets.”

An Economist, Dr Said Boakye, said in a separate interview that while the ratio of interest payments to revenue was good, debt service cost, which combines interest payments with amortisation, as a ratio of total revenue and grants, was a better index.

Dr Boakye, who is the Director of Research at the IFS, said the ratio gave a true picture of the country's ability to service its debt, although the widely used debt-to-gross domestic product (GDP) ratio was also helpful.

Debt service cost

A Graphic Business analysis showed that more than three quarters of total revenue and grants (89.1 per cent as of June 2020) was used to service the GH¢258.4 billion debt stock – pay down the loans and service the interest.

In 2019, the ratio of debt service cost to total revenue and grants was 58.1 per cent but now projected to end 2020 at 71.6 per cent, according to data obtained from the IFS and corroborated from the midyear budget review.

At 89.1 per cent for June 2020 and 71.6 per cent at year-end, the ratio is now the highest in 20 years, beating only the 72.4 per cent per cent recorded in 2000, when Ghana was being prepared for debt forgiveness.

In value terms, the amount used to service debts in the last six months (GH¢19.6 billion) is more than the GH¢11.4 billion that the government requires to fight the raging novel Coronavirus disease (COVID-19) this year and to protect the economy from crashing.

It was also more than the total amount of GH¢14.4 billion that was used to fund capital expenditure, goods and services and transfers to other government agencies – the three critical expenditure items that deliver growth and development in the country.

Debt relief

Beyond its unprecedented nature, the ratio means that the government now has just about a third of non-borrowed revenue left to fund employees compensation, transfers to statutory bodies and other discretionary spending such as capital expenses and goods and services.

Prof. Quartey of the ISSER and Dr Boakye of the IFS concurred that the development was inimical to growth and called for practical measures to bring down the debt through increased revenue generation and reduction in non-productive expenditures.

Dr Boakye reiterated the IFS's position that the current debt cycle could only be reversed if revenue was able to grow at an unusually high rate, growth in employee compensation drastically reduced, the country's debts were forgiven as happened in the 2000s or a combination of some or all of the above occurred.

"However, none of these is easy to achieve in practice, even before the pandemic hit," he added.

He also mentioned tax exemptions as one of the loopholes that needed to be plugged to help raise revenue.

The government has estimated that tax exemptions will cost GH¢3.1 billion this year.

Push factors behind debt growth

Strong growth in employee compensations

Strong growth in debt service expenditure

Maturing campaign promises

Decline in revenues and grants

Pressure from populace for public amenities and jobs

Dry up of concessionary loans

Pull factors behind debt growth

Appetising nature of Eurobonds (Since issuing its debut Eurobond in 2007, Ghana has been a frequenter to the Eurobonds markets, returning to it eight times (once every year from 2013), to take a total of US$13.5 billion in non-cedi loans.

The value issued per auction has also quickened from a maximum of US$1 billion per year between 2013 and 2016 to a minimum of US$2 billion per year between 2017 and this year.)

Attractive rates on commercial loans

Cedi depreciation (foreign loans become buffer in the fight against cedi depreciation although they ultimately weaken the currency)