Digging for opportunity: Harnessing Sub-Saharan Africa’s wealth in critical minerals

The global push to mitigate climate change is driving a significant demand for critical minerals, vital for transforming the energy system and developing low-emission technologies.

Advertisement

Integral to this transition are electric vehicles, and renewable energy generation, both requiring more minerals than traditional fossil-fuel technologies.

For instance, electric vehicle battery production relies heavily on critical minerals such as lithium, nickel, manganese, and cobalt.

Renewable technologies, including solar panels and wind turbines, require minerals like bauxite (a precursor to aluminum), copper, silicon, and platinum-group metals, among others. The demand for these critical minerals, already gathering pace in recent years, is expected to surge in the coming decades.

The latest International Energy Agency (IEA) 2050 Net Zero Emissions (NZE) scenario (IEA 2023) predicts a doubling and tripling of demand for nickel and cobalt, and a tenfold increase in demand for lithium between 2022 and 2050.

Sub-Saharan Africa, estimated to hold about 30% of the volume of world’s proven critical mineral reserves, is crucial for their supply. The region already significantly contributes to the production of minerals like cobalt, graphite, manganese, platinum-group metals and chromium.

Under the 2050 NZE scenario, the global market for critical minerals is poised for a significant upswing. Global revenues from the production of just four key minerals—copper, nickel, cobalt, and lithium—are estimated to total $16 trillion over the next 25 years (in 2023-dollar terms).

This boom bodes well for sub-Saharan Africa. The region stands to reap over 10 percent of these cumulated revenues—nearly $2 trillion in 2023-dollar terms.

However, the potential for significant revenue from critical minerals hinges on developments in commodity prices, which can be highly volatile, and technological changes (Boer and others 2021).

Fast-paced technological advancements, particularly in the field of electric vehicle batteries, could render certain minerals obsolete. Thus, prudent and transparent resource management, and strategic fiscal planning are vital to successfully navigate these uncertainties and harness the region’s mineral resources.

Adding value to minerals

For oil-exporting nations in the region, the shift away from fossil fuels requires a strategic recalibration of their economic and fiscal policies, underscoring the imperative of diversification in the face of global energy transitions (October 2022 Regional Economic Outlook: Sub-Saharan Africa)

Most sub-Saharan African countries export critical minerals primarily in their raw form, which tend to be lower value added than processing activities.

The economic disparity is evident in a simple market value comparison: raw bauxite fetches a modest $65 per ton, whereas its processed counterpart, aluminum, commands a hefty $2,335 per ton as of end 2023.

Although countries in the region have deepened their involvement in the global mineral trade and become more integrated into global value chains, they mainly focus on basic extraction.

The Democratic Republic of the Congo, accounting for 74% of global cobalt mining, sends 97% of its cobalt exports, mostly unprocessed, to China.

Similarly, over 1,000 trucks are estimated to daily transport low-concentration, rock-form lithium from Zimbabwean mines to distant African ports, destined for China instead of undergoing local processing (Goldman Sachs 2023).

This approach starkly contrasts with China and Indonesia, who have prioritized mineral processing for higher economic returns. By sticking to the lower value-added stages of extraction, countries risk losing substantial benefits from processing.

Local processing industries

Developing local processing industries could significantly boost profits, increase tax revenues, create higher-skilled jobs, and enhance positive technological spillovers.

Furthermore, transitioning from exports of raw minerals to producing refined minerals offers an opportunity for countries to diversify their economies and reduce their exposure to high price volatilities commonly associated with raw commodity markets.

By diversifying in this way, countries can better protect against various economic challenges including exchange rate volatility, pressures on foreign reserves, and the financial instability commonly linked to dependency on raw commodity exports.

Advertisement

In their quest to harness the potential benefits of local mineral processing, various sub-Saharan African countries have implemented a range of inward-looking policies, so far, with mixed success.

Currently, 17 countries in the region enforce local content regulations in mining and related activities, encompassing domestic ownership, local employment quotas, and procurement guidelines for foreign investors.

However, these policies often prove costly and challenging to enforce, sometimes resulting in inefficiency and rent-seeking behavior. Notably, past export bans on minerals, as seen in Tanzania and Zambia, have paradoxically led to decreased local production of processed and raw minerals.

Without resolving the fundamental constraints limiting processing capacity, export controls may actually deter investment and shift mining and processing activities to alternative markets.

Advertisement

More generally, the region faces a myriad of challenges in establishing processing industries. A major hurdle is securing financing for countries eager to build factories for mineral processing. Public finances have been especially under strain, given the string of recent shocks. But money is only part of a larger puzzle.

Lack of expertise

Domestic firms in the region lag behind in the know-how and expertise needed for the leap to sophisticated, more value-enhancing processing.

The region’s lack of infrastructure and energy system, too, looms as a sizable impediment especially given the dearth of public financing.

Beyond meeting the high energy demands of processing plants, a comprehensive transport network—trains, containers, trucks, and ample storage space, all integrated with custom port facilities—is vital for the efficient movement of bulk minerals.

Advertisement

Foreign direct investment (FDI) could address some of these complex challenges. It offers much needed capital to construct and upgrade processing facilities, but also a gateway to advanced technology and expertise.

Greenfield FDI, which establishes new operations from the ground up, is especially impactful. It spurs technology transfer, job creation, and skills development.

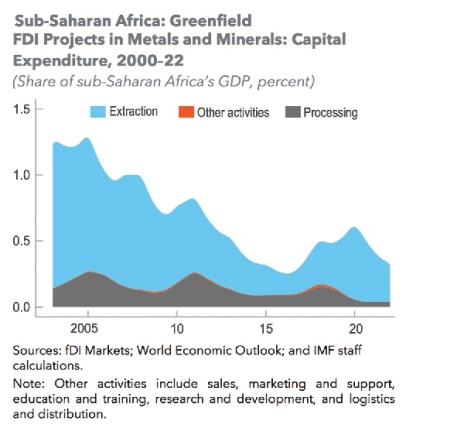

Moreover, FDI often reflects a foreign investor’s long-term commitment, leading to enduring economic benefits. Between 2016 and 2022, sub-Saharan Africa drew about 13 percent of announced global greenfield FDI projects in metals and minerals annually, but 73% went towards extraction and only 26%, on average, towards manufacturing and processing.

Multinationals—a significant source of FDI—not only seek stable sources of raw material but also sizable markets to sell the processed critical minerals.

Thus, the absence of a substantial regional market in sub-Saharan Africa makes local processing investments less enticing.

Sub-Saharan Africa’s wealth in critical minerals presents an opportunity to pivot from exporting raw materials to developing processing industries to capture more value-added benefits.

A regional policy approach that leverages the diversity in minerals and pools resources can tackle challenges more effectively than isolated efforts.

At the country level, structural reforms can complement these regional efforts, nurturing domestic firms in both the processing sector and its supportive industries.

This will amplify the collective benefits of the region’s critical minerals.

In particular, countries can enhance regional integration and coordinate regulations on critical minerals to make the region more attractive to investors.

Bolstering regional integration can forge a larger and more interconnected market, enhancing the region’s investment appeal. The region is uniquely poised to provide both a significant consumer base for processed minerals and a source of raw materials needed in production.

For example, sub-Saharan Africa’s anticipated population boom, coupled with rapid urbanization and industrialization will likely increase demand for renewable energy.

Reducing trade barriers and improving connectivity through infrastructure development are crucial to facilitate the sourcing of various components from different countries.

The African Continental Free Trade Area can play a key role in this, potentially uniting fragmented mineral markets for larger-scale operations and forming regional value chains that draw on both raw and processed mineral inputs.

A regional integration strategy not only taps into a rich material source but also unlocks a thriving consumer market for processed minerals and renewable energy products.

Countries need to collaborate on policies to create more favorable investment and business environments, prioritizing openness over protectionism. Simplifying bureaucratic procedures and harmonizing mining regulations across borders would foster a stable, predictable investment environment.

A regional approach to resource taxation alongside a well-crafted regional mining tax treaty, can decrease tax competition between countries and more effectively harness resource revenues (Bourgain and Zanaj 2020; Perry 2022).

Complementing regional efforts, countries can undertake structural reforms to support domestic companies in mining and related processing sectors. The application of local content requirements, which mandate the use of local materials and labor, should be approached with caution.

Many countries need to reevaluate their inward-looking policies. Despite their intentions to strengthen domestic industries, these policies can often result in inefficiencies, market distortions, and increased costs.

Importantly, isolationist and protectionist policies can lead to adverse outcomes like trade disputes and retaliatory actions.

Adopting a broader reform agenda aimed at fostering a business-friendly environment might prove more fruitful and less fraught with adverse effects.

Reducing entry barriers and simplifying regulatory and tax frameworks can stimulate growth in ancillary sectors, boosting overall competitiveness.

A critical part of this approach is strengthening domestic financial markets and improving access to finance. Here, new fintech innovations could be helpful, particularly for small and medium enterprises and entrepreneurs.

These firms often play a vital role in providing goods and services to the mining sector but face difficulties in securing traditional financing. These reforms would not only support these businesses but also bolster the wider benefits of mining.

Lastly, the adoption of robust fiscal and institutional frameworks is key to responsibly managing the new resource windfalls, whether from extraction or processing.

Priority should be given to enhancing accountability and transparency, designing an appropriate tax regime, and implementing sound public financial management practices.

This moment presents a critical window to secure future prosperity by negotiating favorable contracts and fortifying resource management strategies for the decades ahead.