Ghana’s public debt crisis: Lessons for the future (1)

The present paper examines the issue of the current Ghana’s public debt crisis, its underlying causes and lessons for the present and the future.

Advertisement

After providing a historical discussion, we show that the austerity of the last four years has been unsuccessful in stabilising the debt while, at the same time, it has taken a heavy toll on the economy and society.

The IMF country report (2022) showed that the public debt was unsustainable as the total public debt stock at the end of 2022 amounted to GH₵546.15 billion, which constituted 88.1 per cent of GDP (105 per cent of GDP with inclusion of key SOEs and allied debts) with debt service to revenue reaching 117 per cent and clearly that public debt was clearly unsustainable; therefore, that the government argued that a bold restructuring of the debt was needed for the Ghana economy to reignite its engine of growth.

An insistence on the current policies is not justifiable either on pragmatic or on moral or any other grounds.

The experience of Ghana in the early HIPC/MDRI period provides some useful hints for the way forward.

A solution to the public debt problem is a necessary but not sufficient condition for the solution of the current Ghana’s public debt crisis.

Ghana’s high debt meant that a significant proportion of convertible currency was consumed by debt thereby limiting the countries to import goods and services in the 2022/2023.

Debt service also constituted a considerable share of the budget and so imposed significant constraints on domestic investment.

Default

In December 2022, the government defaulted on both domestic and external debt payments and out the debt crisis, the government and IMF called for debt sustainability through debt restructuring.

The domestic debt exchange (DDE) program, where the stock of Government of Ghana debt was to be halved from 105 percent of GDP (including contingent liabilities) to 55 percent of GDP by 2028 was launched, starting off with the domestic debt exchange.

The result shows excessive public debt had negatively affected the confidence of local investors in the government bonds, and any restructuring of external debt has already caused reputational on the economy and has also depressed foreign direct investment and other foreign capital inflows into the country including international cocoa syndicated loans for 2023/2024.

Another area concern of the public debt is that 2024 happens to be an election year and where Ghana has been noted for some expenditure escalations during an election year.

The government must ensure that there no up-tick unbudgeted expenditures in the upcoming 2024 elections, which could derail the fiscal consolidation.

Measures

Measures by the government should be tailored towards improving economic recovery by designing policies that will reduce the burden of debt accumulation and reducing the cost of public debt servicing through robust fiscal consolidation.

This could be done in the medium term through enshrining debt limit or debt cap of 50 per cent of GDP in the Ghana’s 1992 constitution to put brake on the unproductive borrowing, improving domestic revenue mobilisation, for example instituting adequate property taxes through digitalisation, enhancing the debt management process and transparency; avoid excessive borrowing from both domestic and external sources; fiscal consolidation through aggressive public expenditure cuts, limiting public sector wages and compensation increases which constituted the biggest line of expenditures (GH¢44 billion and GHC 66 billion) in both 2023 and 2024 government budget statements respectively, and also the country must make conscious effort to reduce the endemic corruption in the public sector debt and improving efficiency in funds utilisation. A wider agenda that deals with the malaises of the Ghana’s economy and the structural imbalance of the country is of vital importance.

Background

The Ghana’s economic and financial crisis of the last three years has been the most severe crisis that a developed economy has ever experienced in modern history, both in terms of output and employment loss as well as duration.

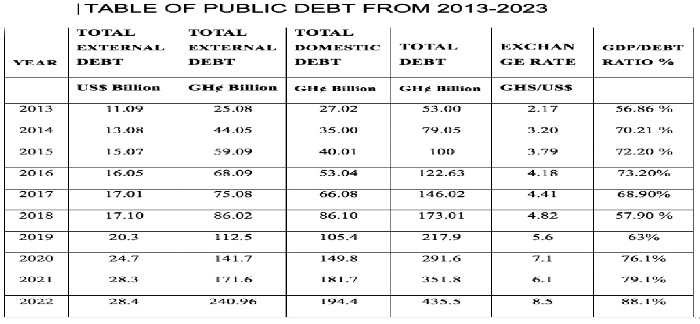

In 2012, Ghana’s debt increased sharply from GH¢35.1billion or 48.4 per cent of GDP to GH¢122.6 billion or 73.3 per cent of GDP in 2016, indicating an increase of GH¢87.5billion or 24.9 percentage points of GDP in four years.

However, Ghana’s nominal debt has increased from GH¢122.6 billion or 73.3 per cent of GDP to GH¢546 billion or 88.1 per cent of GDP in 2022 and further increased to GH¢610 or 72.5 per cent of GDP despites a comprehensive and painful domestic debt exchange program in September 2023.

The situation in Ghana is a testament to the catastrophic effect that excessive borrowing has exerted on an economy and the disastrous consequences on the social fabric as well as high poverty levels. One of the core issues in this contemporary Ghana tragedy has been public debt. When the crisis started in 2022 with a debt-to-GDP ratio around 100 per cent, it was interpreted by most economists and policy makers as a public debt crisis.

The result of these efforts will be a slowdown of the increase in debt and a boost to growth and therefore a decrease in the debt-to-GDP ratio.

Foreign debt accumulated rapidly with corresponding interest payments between 2019- 2022, as the country ran into economic difficulties and suspended payments on foreign debt on December 2022, private and public investment collapsed, with total investment to GDP by as much as 5 percentage points.

Ghana registered largest fiscal deficits in the past decade, which reached its peak in 2020 with an unprecedented deficit of 15.2 per cent of GDP, and thus sharply increasing the country’s debt stock and debt service costs, thereby creating enormous budgetary difficulties, the government of Ghana naturally aimed at achieving fiscal consolidation in the original 2022 budget.

To be continued.....