Govt initiates major tax cuts to stimulate growth in 2017 Budget

The government has set in motion measures to actualise some of its campaign promises with major tax reliefs in its Budget Statement and Economic Policy for the 2017 financial year.

Advertisement

The reliefs are meant to prop up the private sector, which is expected to be the engine of growth to create jobs for the teeming masses of Ghanaians without employment.

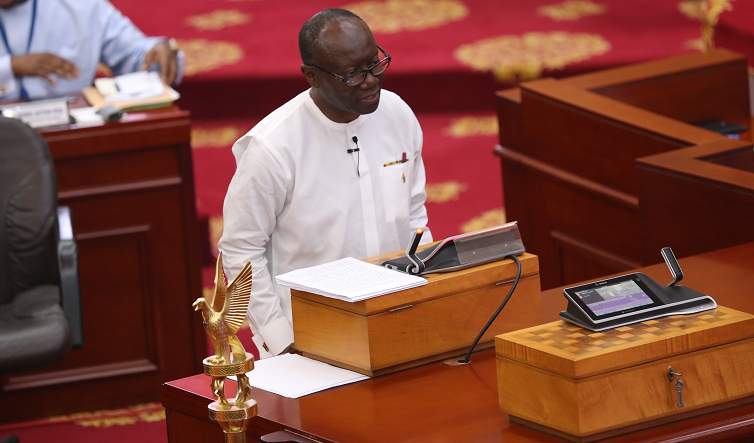

Laying the budget, which was on the theme: “Sowing the seeds for growth and jobs”, before Parliament on behalf of President Nana Addo Dankwa Akufo-Addo, the Minister of Finance, Mr Ken Ofori-Atta, said the government would abolish the one per cent special import tax, market tolls paid by kayayei, the17.5 per cent Value Added Tax/National Health Insurance Levy (VAT/NHIL) on financial services and the 17.5 per cent VAT/NHIL on domestic airline tickets.

In Parliament to support the Finance Minister were the Vice-President, Dr Mahamudu Bawumia, who is the Head of the Economic Management Team, and the Senior Minister, Mr Yaw Osafo-Maafo, himself a Minister of Finance in the erstwhile Kufuor administration.

Clad in his signature white apparel, with a touch of Kente, the soft-spoken Finance Minister projected his voice rather sonorously as he announced further tax reliefs.

They were the abolition of the five per cent VAT/NHIL on real estate, import levies on spare parts, the 17.5 per cent VAT/NHIL on selected imported medicines not produced locally, replacing the 17.5 per cent VAT/NHIL with a three per cent flat rate for traders on the Ghana Stock Exchange (GSE), as well as giving tax credits and other incentives to businesses that employ young graduates.

In what was expected to bring some level of relief to the public, Mr Ofori-Atta, who was occasionally heckled by members from the Minority side, said the government had also reduced the special petroleum tax rate from 17.5 per cent to 15 per cent, reduced the national electrification scheme levy from five per cent to three per cent, reduced public lighting levy from five per cent to two per cent and abolished levies imposed on religious institutions by local authorities.

The reliefs, the minister said, were meant to make the cost of doing business cheaper and set the stage for job creation.

Resource mobilisation for 2017

In the area of resource mobilisation to finance policies and programmes, he said total revenue and grants, including programmed receipts from petroleum for the 2017 fiscal year, were estimated at GH¢44.96 billion, equivalent to 22.1 per cent of gross domestic product (GDP), indicating a 33.5 per cent increase over the provisional outturn in 2016.

“Total non-petroleum revenue and grants are estimated at GH¢42,603.5 million, equivalent to 21.4 per cent of non-oil GDP, representing a 29.2 per cent increase over the provisional outturn in 2016,” Mr Ofori-Atta said.

Total receipts from petroleum, he said, would amount to GH¢2.36 billion or 1.2 per cent of GDP, representing a 231.2 per cent increase over the outturn in 2016.

He said domestic revenue, made up of tax and non-tax revenue, was estimated to be 33.5 per cent higher than the provisional outturn in 2016, amounting to GH¢43.43 billion or 21.4 per cent of GDP.

“Mr Speaker, total tax revenue is estimated at GH¢34,382.1 million, representing 16.9 per cent of GDP. This estimate also represents an increase of 33.6 per cent over the provisional outturn in 2016. Of this amount, non-petroleum tax revenue is estimated to grow by 32.4 per cent and this amounts to GH¢33,765.3 million, equivalent to 16.9 per cent of non-oil GDP,” the Finance Minister added.

Taxes on income and property, Mr Ofori-Atta said, had been estimated to increase by 47.7 per cent to GH¢13.44 billion in 2017, accounting for 39.1 per cent of total tax revenue. Of the amount, royalties from petroleum were estimated at GH¢616.8 million.

“Taxes on domestic goods and services are estimated at GH¢13,863.1 million, representing a 13.3 per cent increase over the provisional outturn in 2016 and 40.3 per cent of the estimated total tax revenue for 2017,” he said.

International trade taxes, he said, were estimated at GH¢7,072.4 million, representing 3.5 per cent of GDP and 20.6 per cent of total tax revenue.

That estimate, he said, represented a 61.1 per cent increase over the provisional outturn for 2016. The significant growth of that tax type emanated mainly from the additional GH¢1 billion in tax measures that would be realised as savings from the reduction in the amount of import exemptions that would be granted in the 2017 fiscal year.

Non-tax revenue

Non-tax revenue, comprising mainly proceeds from the sale of goods and services rendered by ministries, departments and agencies (MDAs), dividend received from public enterprises and other internally generated funds (IGFs), the minister said, was estimated at GH¢6.67 billion, equivalent to 3.3 per cent of GDP.

He said GH¢3,361.6 million was expected to be retained by MDAs for the funding of their activities and the remaining lodged into the Consolidated Fund, adding: “Of the total amount estimated for non-tax revenue, GH¢1,741.4 million is estimated as non-tax petroleum revenue.”

“Mr Speaker, given our commitment to fiscal transparency, we have estimated an amount of GH¢2,081.7 as receipts from the Energy Debt Recovery and the Price Stabilisation and Recovery levies. These are the other energy sector levies other than the Road Fund and Energy Fund levies which are already part of the petroleum excise tax,” he said.