Atiwa Rural Bank makes gains

Despite the downturn in the country which has negatively affected some financial institutions, the Atiwa Rural Bank made a profit before tax of GH¢1,246,231 in 2021 as against GH¢573,696 in 2020, a rise of 117 per cent.

The bank's short and medium-term investment in government’s securities within the same period increased from GH¢18,923,250 to GH¢21,548,241, a rise by 14 per cent.

Advertisement

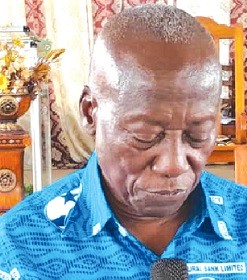

These achievements of the bank were announced by the bank's Board Chairman, Emmanuel Ampofo Duodu, during the 33rd annual general meeting of shareholders at Kwabeng, the bank's headquarters in the Atiwa West District of the Eastern Region last Saturday.

According to the board chairman, other areas where the bank made significant gains were assets which increased by nine per cent, primary reserves which increased by 11.2 per cent and was thus higher than the minimum statutory requirement of six per cent in 2021, while secondary reserve for the year 2021 was 43.38 per cent, which was higher than the minimum statutory requirement of 30 per cent.

Deposit

He explained that the bank's deposit performance for the period was highly influenced by a decline in economic activity at the bank's major areas of operations.

That development, Mr Duodu indicated, greatly affected deposit mobilisations, with total deposit increasing by three per cent from GH¢33.3 million in 2020 to GH¢34.3 million in 2021.

The loan portfolio, which enabled customers and shareholders to cushion themselves, also rose from GH¢10,133,339 in 2020 to GH¢11,075,760 in 2021, the Board Chairman told shareholders.

Dividend

With regard to dividend payment, Mr Duodu stated that in compliance with the Bank of Ghana directive, a dividend of 0.002 per share would be paid to shareholders to enable them have confidence in the bank and also to increase their shareholding to guarantee better returns in the future.

On the bank's future developments, he pointed out that new branches would be opened at Nkawkaw and Abomosu to further strengthen its operations.

That, the board chairman stated, would rope in more customers and shareholders. Mr Duodu appealed to shareholders of the bank to continue to support it to grow.

Right measures

The Head of Finance at the ARB Apex Bank, Samuel Gyimah Amoako, who represented the Managing Director, Alex Kwasi Awuah, said due to rapid technological changes in the banking industry, ARB Apex Bank had decided to put in place the right measures.

That, according to him, would help the Rural and Community Bank (RCB) to provide excellent customer service, of which one of the key interventions was mobile banking, where people could link their account to their mobile wallets to transfer funds easily.

He expressed satisfaction about the impressive performance of the bank during the period under review and stressed that it was worthy of emulation by other RCBs.

Writer's email: [email protected]