Government withdraws Luxury Vehicle Tax

The government has withdrawn the Luxury Vehicle Tax which was introduced last year.

It has also started the National Housing and Mortgage Finance Initiative to provide quality housing for citizens, starting with public and civil servants.

Advertisement

Two of the schemes under the initiative — the National Housing and Mortgage Scheme (NHMS) and the Affordable Housing Real Estate Investment Trusts (REITs) — have already started.

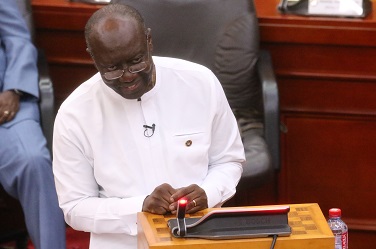

The Minister of Finance, Mr Ken Ofori-Atta, announced these initiatives in Parliament yesterday when he presented the government’s mid-year budget review.

Luxury vehicle

The Luxury Vehicle Tax was introduced in July last year to levy vehicles with big engine capacities, with those having capacities of between 3.0 and 3.5 litres paying an annual tax of GH¢1,000; those with capacities of 3.6 to 4.0 litres paying GH¢1,500 and those with 4.1 litres and above paying GH¢2,000.

According to the government, the introduction was in line with the Sustainable Development Goals (SDGs) to control emissions and reduce their impact on climate change.

However, in his presentation yesterday, Mr Ofori-Atta said: “We have noted suggestions from the general public on the implementation of this tax. As a listening government, we are proposing to the House the withdrawal of the levy.”

He noted that the government would continue to improve tax compliance, expand the tax net and explore other innovative sources of raising revenue.

Innovative sources

The government had projected GH¢136.53 million in revenue from the tax but the revenue collected in the first quarter of the year was only GH¢30.19 million.

The amount is GH¢82.7 million or 79.52 per cent below the GH¢104 million projected to be collected within the period, as contained in the 2018 mid-year budget review.

Housing initiatives

On the housing initiatives, the minister stated that as announced in the 2018 Budget, the government had started the NHMS initiative, with the objective of providing quality housing, “Decent Homes, Better Life” for all citizens.

He said under the NHMS, funds had been released to three participating banks (GCB Bank Limited, Stanbic Bank and Republic Bank) to commence the pilot phase of the housing and mortgage finance scheme.

According to him, the scheme, in collaboration with the Ministry of Employment and Labour Relations, was building a pipeline of potential home owners to participate in the scheme and added that the government was also intervening in the housing market through the REITs to serve as a vehicle for rent-to-own schemes.

“The intention is for the REITs to buy properties and lease them to public sector workers over an extended time and sell at predetermined values.

“The rental payments will count as equity; this will help new entrants into the workforce own properties without the initial huge down payment. Work on the REITs has started in earnest with GCB Securities, a subsidiary of the GCB Bank,” he told Parliament.

Insurance industry

Mr Ofori-Atta asserted that the National Insurance Commission (NIC) had also announced new minimum capital requirements for the insurance industry to address the challenge of low capitalisation

The new minimum capital will apply immediately to newly licensed companies and existing insurance companies will also have up to June 2021 to meet the new minimum capital requirements.

Under the new minimum capital requirements, life and non-life insurers start from GH¢15 million to GH¢50 million, while brokers and loss adjustors start from GH¢300,000 to GH¢500,000, with the minimum capital of reinsurance brokers maintained at GH¢1 million.