Why E-Levy is suffering from stillbirth

In communication studies, there is the agenda-setting theory, when the media emphasises a particular issue in the national discourse.

The E-Levy’s agenda-setting impact has been felt in all parts of the country and very much so in Parliament, where parliamentarians have engaged in fights over it.

Advertisement

Since the inception of the Fourth Republic, both the New Patriotic Party (NPP) and the National Democratic Congress (NDC), have failed to communicate effectively their policies and achievements.

One thing I know about all the ministers in government is that they have public relations or communication officers.

But the question is are those occupying such positions the right ones in terms of knowledge, expertise and experience; and if they are the right people, do the ministers value their advice or input on what they should say or not say; how and when to say or not to say what they plan to say and what to say or not?

Mass communication

It is the act of relaying information from a person, group of people or an organisation including government, to the public or a segment of the public - is a professional venture. Thus, communication as a profession is effectively practised by those who understand its theories and models, especially in the case of the government, the media’s agenda-setting theory and how best to use it.

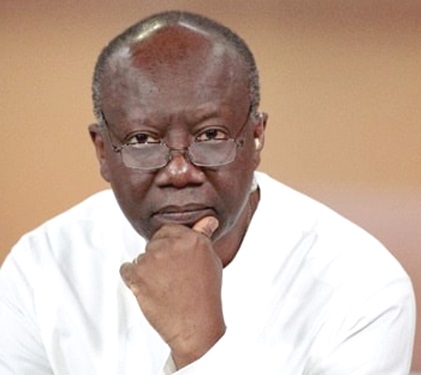

On November 17, 2021, the Minister of Finance, Mr Ken Ofori Atta, in presenting the 2022 budget statement in Parliament, announced the introduction the E-Levy to be charged on mobile money payments, bank transfers, merchant remittances and inward remittances above GH¢100.

Since then, that has become the main topic on the national agenda and the reason is that the communication of the new tax was poorly done, with its coverage also yet to be made known.

The plan for the communication of the new tax should have been made somewhere in the early part of last year and handed to communication experts.

In the absence of effective communication, many Ghanaians have been fed the wrong information by both government spokespersons with divergent and confusing messages, and those who oppose the tax.

Peter Drucker, an Austrian-American management consultant and educator, argues that “the most important thing in communication is hearing what isn’t said,” and this is exactly what has happened.

The poor communication of the E-Levy has resulted in many hearing what hasn’t been said.

Following the controversies surrounding the E-Levy, the government has now realised its failings in effectively communicating it to the people.

The Minister of Finance is now moving round the country doing townhall meetings to do what should have been done long before its introduction – communicating to the people.

But despite the town hall meetings, there are still some communication problems, as too many NPP members and government officials keep making contrasting statements on what the E-Levy is.

Not communicating

Even some of the ministers joining the Finance Minister in his townhall meetings are not communicating; they are only creating semantic noises (word choices that are confusing and distorting).

At the Tamale townhall meeting, the Ghana News Agency (GNA) reported that even after Mr Kojo Oppong Nkrumah, Minister of Information, had assured mobile money vendors that the E-Levy would not collapse their business, some participants said they were not convinced by the arguments he and other ministers had made.

Even the NPP’s Director of Communication, Yaw Buaben Asamoa, said in Kumasi recently that, “the E-Levy will serve as a catalyst for private sector investment both local and foreign into productive areas”.

How does this statement answer for instance, the question about accountability the people are asking?

While the Finance Minister is appealing to Ghanaians to accept the levy, his deputy, Abena Osei Asare, says Ghanaians are not against it and that the government would ensure its passage.

What makes her that sure; and if it was that easy, why has the government not passed it?

Also, the New Juaben South MP, Michael Okyere Baafi, asked Ghanaians to change their mobile networks if the levy was expensive for them.

He has also stated that if Ghanaians reject the E-levy, the government will scrap the free SHS.

And on the use of the revenue to accrue from the tax, we still do not know what precisely it would be used for as each government spokesperson gives one target or another.

For instance, Ms Osei Asare says government is “going to use some to reduce our elevated debt levels which came about as a result of the COVID-19 pandemic”, a clear addition to what her boss has said.

Also, whereas the Finance Minister says only two per cent of Ghanaians pay tax, the NPP Western Regional Secretary, Charles Bissue, says it is four per cent.

The Majority Leader and Minister for Parliamentary Affairs, Osei Kyei Mensah-Bonsu, and his deputy, Alexander Afenyo-Markin, have also made contradictory statements, with the latter announcing the withdrawal of the tax, only for the former to contradict him.

Need

What the government needs currently is a long-term strategic communication plan whose success would depend on the creation and maintenance of public trust, which is presently missing.

One of the biggest problems facing the government now is how to convince us that there will be proper accountability, transparency and effective usage of taxes collected.

So why can’t the people be told now of some of the projects undertaken in the last five years, how much they cost and the sources of their funding?

In 1995, the NDC government introduced the Value Added Tax (VAT) meant to replace both sales and services taxes.

The public rejected the new tax, arguing that it would be inflationary.

Despite the nation-wide protests, including the famous Kumi Preko demonstrations, the tax was introduced and operated for about two months before it was stopped.

Following that, an intensive national education campaign was undertaken and the VAT was eventually reintroduced in 1998 without protests.

As the situation is, my appeal to the government is to suspend the introduction of the E-Levy and continue to engage all stakeholders and the public on its need.

Withdrawing it now and engaging the public over it will enable the government to smoothly re-introduce it at a later date as it happened to the introduction of VAT.

The writer is Media/Communication Consultant & Political Scientist. E-mail: [email protected]