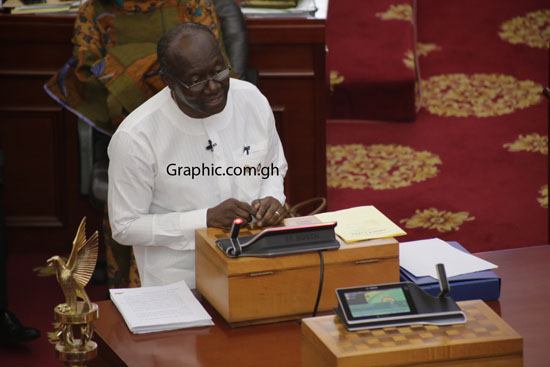

Century bond necessary to stop hand-to-mouth existence – Ken Ofori-Atta

The Finance Minister, Mr Ken Ofori-Atta, has defended government’s plans to issue a Century Bond in the coming months, stating that long-term debts are needed to uplift the country and the citizenry from the “hand-to-mouth existence.”

The debts will also put Ghana on a firm trajectory of growth and prosperity, the minister said when he presented the 2019 Budget Statement and Economic Policy.

Advertisement

He further assured that the government’s overall plan to issue ultra-long-term bonds was not intended to derail the country’s debts sustainability path but to rather enhance it.

“If we really want to uplift ourselves out of this hand-to-mouth existence and put our country, Ghana on a firm trajectory of growth and prosperity, we will need to source long-term, affordable financing to invest in strategic infrastructure over the medium to long-term,” he said

Defending the decision to go long-term, Mr Ofori-Atta said the country’s current phase of massive economic transformation requires a more ambitious financing arrangement.

He explained that the country also needed strategies to retire about half of the country’s existing debt, which

As a result, he said “we shall issue sovereign bonds of longer tenor either as green bonds or Eurobonds on the international capital markets and also structure a Sovereign Century Fund for our bilateral

investor partners.

“The Sovereign Century Fund shall engage on a bilateral basis to raise long-term concessional financing to underwrite our other commercial infrastructure needs through GIIF, GIADEC, PPP projects and other entities as well as liability management,” he added.