ARB Apex Bank secures GH¢34.4m World Bank support

The ARB Apex Bank, the mini-central bank for rural and community banks, has secured $8 million, equivalent to GH¢34.4 million, to roll out agency banking for rural banks.

When launched this year, the rural and community banks can contract small shops and supermarkets in their communities, districts or regions to provide basic banking services for their customers and potential clients.

Advertisement

The approach, which is already being practised by some universal banks, would lead to the creation of many jobs in rural areas as small and medium enterprises sign up to provide rural banking services to the public.

“When deployed, our customers can access a myriad of banking services without necessarily walking into the sometimes imposing banking halls,” the Managing Director of the ARB Apex Bank Ltd, Mr Kojo Mattah, said.

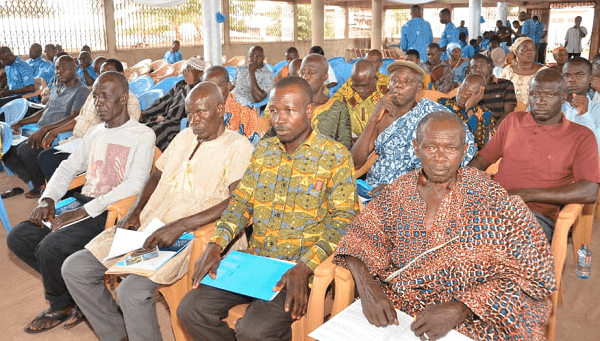

Upper Manya Kro Rural Bank AGM

He was speaking at the 35th annual general meeting (AGM) of the Upper Manya Kro Rural Bank Limited at Asesewa in the Eastern Region on June 8.

Mr Mattah explained that a consultant had already been engaged to guide the seamless execution of the agency banking which would position rural banks to take a substantial stake in the country’s electronic cash and cash-lite society.

The Apex Bank MD commended shareholders, directors and the management of Upper Manya Kro Rural Bank for posting an impressive performance last year in spite of the challenges in the banking industry.

“The main pillar in the continuous success of Upper Manya Kro Rural Bank is its focus on micro and small businesses schemes. While encouraging the bank to concentrate its expertise on this niche area of financial intermediation, I urge sister RCBs to emulate their good example and desist from exposing their banks to big ticket transactions,” Mr Mattah stated.

Financial performance

The bank grew its total income by 20 per cent from GH¢11.7 million in 2017 to GH¢14 million last year, while its loans and advances went up slightly by 3.5 per cent to GH¢41.8 million.

The bank supported its lending activities with an 8.3 per cent growth in its deposits from GH¢37.3 million to GH¢40.4 million.

The Board Chairman of the Board of Directors, Mr James Kwame Otieku, who said this when he presented the annual report of directors to the AGM said about 76 per cent of the loan recipients were women.

“It is worth noting that your bank has reached out to over 15,116 loan customers and this milestone is consistent with our corporate mission of extending credit facilities to the rural productive poor with cost-effective and tailor-made financial intermediation products,” he said.

Although the bank saw a dip in its profit after tax, the GH¢929,000 profit was commendable in the light of the challenges that hit the banking sector which caused a rippling effect on the rural banking industry.

CSR

The Upper Manya Kro Rural Bank spent more than GH¢77,000 on corporate social responsibilities, which included the provision of 100 bunk beds for the Agogo Senior High School, a teachers’ bungalow project, support for the Farmer’s Day and traditional councils.

Having recorded a 3.88 per cent growth in capital, 7.14 per cent growth in assets and a 5.75 per cent growth in shareholders’ funds, the bank also declared a dividend of GH¢0.008 per share with a commitment to continue to grow the business.