Macro-economic targets revised downwards — Projected GDP now 3.7%

THE government has revised its macro-economic and fiscal targets in the 2022 budget due to changes in the macro-economic environment, coupled with revenue mobilisation challenges.

Overall gross domestic product (GDP) growth which was projected at 5.8 per cent has now been revised downwards to 3.7 per cent, with non-oil GDP also reviewed downwards from 5.9 per cent to 4.3 per cent.

Advertisement

The overall fiscal deficit has also been lowered to 6.6 per cent of GDP from 7.4 per cent, with the primary surplus down to 0.4 per cent of GDP up from a surplus of 0.1 per cent of GDP.

The Gross International Reserves which became a major bone of contention in Parliament last week, has also been revised to not less than three months of import cover.

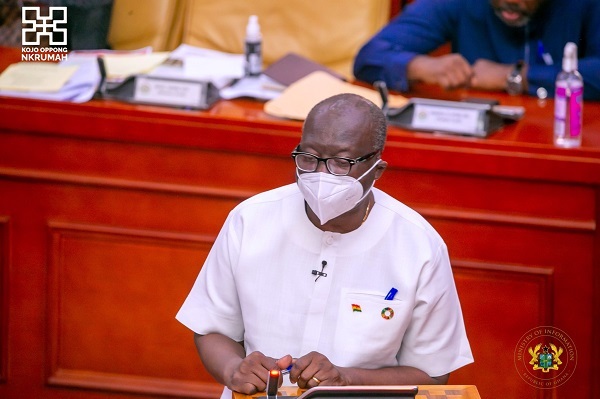

The Minister of Finance, Ken Ofori-Atta announced these changes when he laid the Mid-Year Review of the Budget Statement and Economic Policy of the Government for the 2022 fiscal year, in pursuant of the Public Financial Management Act (PFMA), 2016 (Act 921).

“Mr Speaker, as I have already indicated, the macroeconomic environment has significantly changed, prompting the revision of the macroeconomic framework.

Furthermore, based on the developments for the first six months of 2022 and outlook for the rest of the year, we have accordingly revised the macro-fiscal targets for 2022,” he stated.

Fiscal framework

Mr Ofori-Atta pointed out that the government had also revised the 2022 Fiscal Framework due to the fiscal performance for the first half of the year which witnessed shortfalls in the expected yields from the new 2022 revenue measures.

He said the first six months of the year had also witnessed some additional expenditure measures which include the moratorium on foreign travels except pre-approved critical and/or statutory travels; 50 per cent cut in fuel coupon allocations for all political appointees and heads of government institutions.

Accordingly, he said total revenue and grants have now been revised to GH¢96,842 million (16.4% of GDP) in 2022, down from the 2022 Budget target of GH¢100,517 million (20.0% of GDP) representing 3.7 percent reduction.

He said total expenditure (including payments for the clearance of arrears) had also been revised downward to GH¢135,742 million (22.9% of GDP) from the original budget projection of GH¢137,529 million (27.4% of GDP).

Interest payments have also been pushed upwards from GH¢37,447 million (7.5% of GDP) to GH¢41,362 million (7.0% of revised GDP), mainly on account of inflationary pressures and exchange rate depreciation resulting in higher cost of financing.

Revenue measures

The Finance Minister also announced some additional; revenue measures that would be pursued for the second half of the year.

He said the introduction of an Electronic VAT (E-VAT) system which seeks to digitise the revenue mobilisation processes remained a key focus for the government and as such, the Ghana Revenue Authority (GRA) was finalising all relevant processes to facilitate the effective collection of VAT revenue under the system.

He said this would involve the proposed amendment of the Value Added Tax Act (Act 870) to enable its electronic collection, effective October 1, 2022.

Mr Ofori-Atta also noted that the Ministry of Finance, together with the Ministry of Local Government, would continue to assist and support the local assemblies, not only to expand their revenue base, but to do so with optimal efficiency and effectiveness.

“Therefore the collective efforts of the local government, the Assemblies, and the GRA in launching an end-to-end digitalised process to collect property tax will be realised by August,” he stated.

He said the government would also introduce an upfront payment of VAT on importers not registered for VAT with implementation with a start date of October 1, 2022.