Post-IMF budget today- Economists caution govt

Three economists have asked the government to use the 2019 budget to signal to the investor community that the country is prepared to maintain fiscal discipline in the absence of the International Monetary Fund (IMF).

Advertisement

They, therefore, advised the government to set a realistic deficit target of between five and 5.5 per cent of gross domestic product (GDP) to help the country gain international credibility and consolidate the gains chalked up under the IMF’s extended credit facility (ECF).

The three were speaking to the Daily Graphic on what a post-IMF budget should look like.

IMF programme

After three years of fiscal consolidation with the IMF, the country will exit the ECF programme in December this year, although final reviews are scheduled for the first quarter of next year.

Among other things, the programme has reversed the fiscal slippages recorded between 2012 and 2016 by easing the deficit from 9.3 per cent of GDP on

The 2018 budget now estimates that the deficit will fall further to 4.5 per cent of GDP.

While predicting a higher fiscal deficit target for 2019 compared to 2018, Prof. Quartey, who is the Head of the Economics Department at ISSER, said he did not expect “too high a deficit”.

“At the same time, we should find ways of raising more revenue so that we can contain the deficit,” he added.

Since 2017, revenue and grants have been falling below targets, forcing the government to cut its expenditures in order to keep the deficit within check.

In the first seven months of this year, provisional data on fiscal operations which were budgeted to end July at GH¢27.17 billion (11.2 per cent of GDP) yielded GH¢24.73 billion (10.2 per cent of GDP).

Continue with trend

Mr Boti, an Economics Analyst at Databank, said the government had fared well with the economy over the last two years and needed to use policies to entrench the gains.

“Now that the IMF is not in the system, I think that is where investors will be looking out for cues as to the sustainability of the gains we have chalked up so far.

“Now, without the watchful eyes of the IMF, are we going to continue on that path?” he asked.

He said although there were some legislative provisions to help entrench fiscal discipline, financing of infrastructure projects could spring a surprise on the fiscals.

“If past issues with the Chinese do not pop up again, where with the China Development Bank (CDB) loan they disbursed part and withheld the rest, then the government may be tempted to find other sources of finances to finance those roads and bridges, and that is where the drain on the budget will come from,” he said.

The government is working to access some US$2 billion from China – the Sinohydro Bauxite deal – under a barter arrangement to finance the construction and rehabilitation of selected roads and bridges nationwide.

Yielding to pressure

Although Dr Boakye, who is a Senior Research Fellow at the IFS, declined to give specific figures, he said it was ideal for the government to resist the temptation to spend more and contain the deficit to entrench the fiscal gains.

He was worried that the government would yield to pressure to actualise its campaign promises by resorting to high borrowing in order to fund some projects.

Appeal

Meanwhile, some businesses have appealed to the government not to increase or introduce new taxes in its 2019 Budget Statement and Economic Policy which is due to be presented to Parliament today.

They are rather expectant that the revenue and expenditure estimation tool for next year will announce measures that will broaden the tax base and plug loopholes to help boost revenue collection and stimulate growth in the private sector.

Speaking to the Daily Graphic in separate interviews ahead of the presentation of the 2019 Budget and Economic Policy Statement, representatives of the Association of Ghana Industries (AGI), the Ghana Union of Traders Association (GUTA) and the Ghana National Chamber of Commerce (GNCC) said their members were already overburdened with the current tax regime, such that any further increases or introduction of new ones would worsen their plights.

They mentioned the conversion of the Ghana Education Trust Fund (GETFund) and National Health Insurance (NHI) levies into straight taxes, import duties, corporate and the environmental taxes as some of the categories of taxes that were particularly high and should be reduced or realigned to help bring relief to businesses and encourage operators to be tax-compliant.

Beyond the taxes, the representatives said the budget should also help address the perennial cedi depreciation,

Prioritise manufacturing

The Chief Executive Officer (CEO) of the AGI, Mr Seth Twum-Akwaboah, said the AGI was convinced that the country had in place enough and adequate tax arrangements which when properly harnessed, would yield the needed revenues.

“We think that it is not also good for us to frequently change our tax laws. Emphasis should be put on how to get people to be tax-compliant but no new taxes should be introduced,” he said.

He added that the conversion of the GETFund and NHI levies from value added to straight taxes was inimical to manufacturers, hence the need to review.

He explained that the cascading effect in the new tax regime did not support manufacturing, adding that: “It is actually inconsistent with the government’s own agenda of pushing manufacturing in the country.”

“For that particular policy, companies that have different distribution chains suffer more because it is now a cost,” he said.

He said the government also needed to disclose how collections of the environmental tax had fared and how they had been applied for the purposes for which it was introduced.

Mr Twum-Akwaboah said the AGI also expected the government to further stabilise the cedi Firefighting approach For his part, the CEO of the GNCC, Mr Mark Bedu-Aboagye, said the chamber expected the 2019 budget to move the economy from taxation to production in line with the New Patriotic Party (NPP) government’s manifesto pledge.

“There should not be an introduction or increase in any taxes whatsoever because we are already overburdened with taxes at the moment.

“We are expecting that they come out with innovative ways of expanding the tax net to include individuals and those who are conducting business activities but not paying taxes. They should be brought under the tax net to also pay some,” he said.

According to him, although treasury bill, Bank of Ghana policy rate and inflation had declined considerably in recent months, interest rates on loans had remained high, indicating a disconnect in the economy.

That, he said, needed to be corrected “with a clear policy direction” that would make interest rates respond to the policy rate.

“There should also be a clear action on how to stabilise the cedi.

The firefighting approach of whenever there is depreciation then we look for money from the cocoa syndicated loan, it stabilises and we go back to sleep only for the situation to reoccur is not helpful.

“We want a comprehensive approach on how they want to deal with it,” he said.

Peg dollar

The President of GUTA, Dr Joseph Obeng, said the trading community was convinced that the government had the means and wits to stabilise the depreciation of the cedi against its foreign counterparts.

In the short term, however, he said GUTA expected the government to peg the US dollar to a stated amount of cedi for the purposes of payment of duties.

That, he said, would help insulate the businesses from incurring capital losses as a result of the depreciation.

Dr Obeng also called for a review of the tax exemptions policy to reduce the abuse.

“We think that it is being abused. The number of containers that do not pay import duties as a result of this exemption regime is almost the same as those of us who pay and the situation does not ensure parity.

“So even if this policy is necessary at all, then we want the government to do everything possible to plug every loophole that can subject it to abuse,” he said.

Post-IMF budget

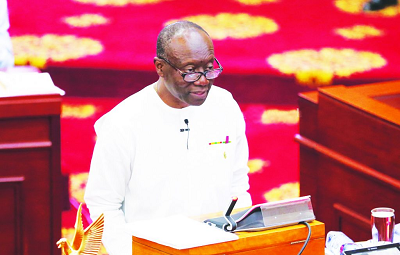

Although its third budget after taking office in 2017, the government will be presenting the 2019 budget as the first that will not feature the conditions and demands of the International Monetary Fund (IMF).

Since 2015, the IMF has been helping the country stabilise the economy under a three-year extended credit facility programme.

The programme ends this December, with final reviews scheduled to take place in the first quarter of next year.

In a related development, spare parts dealers at the Abossey Okai Market Square say they expect the government to use the 2019 budget to reduce duty rates, writes Daniel Ofosu Dwamena.

According to the dealers who spoke to the Daily Graphic ahead of the budget presentation, persistent high duty rates at the ports had slowed down their business as they were unable to sell their products on time due to high prices.

Import duty on imported spare parts currently hovers around 51 per cent, the highest in the sub-region.

“Duty rates are taking both our capital and profits. For instance, if you import goods worth about US$100,000, you are expected to pay almost about US$51,000 as

He indicated that most spare parts dealers had halted the importation of parts into the country.

Mr Paddy, therefore, said: “We expect the government to reduce duty rates for us, as well as put in policies that will stabilise the dollar against the cedi. These are our major expectations in the budget as a trading community.”

In furtherance, he explained that the depreciation of the cedi against the dollar had made it difficult for businesses and