NTHC chases directors of firms over GH¢500m

The National Trust Holding Company (NTHC) is chasing directors of some non-bank financial services companies and other businesses to recover over GH¢ 500 million to shore up the fortunes of the struggling state company.

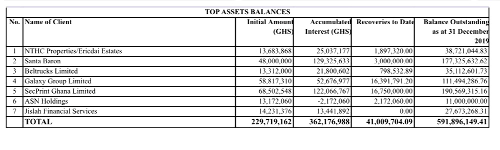

The companies include TG Automobile, Galaxy Finance Limited, Beltrucks Limited, its own subsidiary, NTHC Properties, and Eric Dail Joint Ventures, which obtained loans from NTHC without recourse to standard risk management practices.

Advertisement

The rest are Santa Baron, SecPrint Ghana Limited, ASN Holdings Ltd and Jislah Financial Services, each of which obtained loan facilities without an assessment of their ability to repay.

This follows a Forensic Investigations Report conducted by the auditing firm, KPMG, which alleged that a former Managing Director of NTHC, Dr Albert Walter Quarcopome Barnor, and the former Head of Corporate Finance and Research Unit, Francis Nyoagbe, recommended and approved loan facilities to the companies without due diligence and risk assessment.

But the former Managing Director has rejected the findings of the audit report, which is now the subject of a probe by the Economic and Organised Crime Office (EOCO), describing it as not factual.

Other charges against NTHC under Dr Barnor are that he did not maintain proper documentation of investment certificates and correspondence in the facilities he granted Galaxy Finance.

Dr Barnor’s response

Dr Barnor and Mr Nyoagbe did not monitor investment activities, including roll over and redemption of interest earnings.

But responding through his lawyers, Alliance Law Unlimited, Dr Barnor denied the charges, saying all credits and assets backed commercial paper requests were subjected to rigorous due diligence by the Corporate Finance Department to determine viability of proposed projects and businesses as well as capacity to repay.

He explained that the property investment desk of NTHC helped in the evaluation processes by assessing the collateral securities and subsequently registering the collateral in the bank of Ghana registry in accordance with the Lenders and Borrowers Act 773.

Dr Barnor said the management of NTHC should have made the credit documents available to KPMG in the course of the forensic audit.

“A complete examination of client files by KPMG should make this obvious and save this obviously ignorant statement”, Dr Barnor charged.

Bailout

The stated-owned investment firm, in June this year, requested an urgent bailout from the government to enable it to meet its indebtedness to rural and community banks (RCBs) across the country.

The GH¢500 million bailout request is also expected to help the trust to settle its numerous retail customers, who have been victims of its liquidity crunch since 2019.

The company’s debt overhang has its roots in the financial sector clean up exercise that occurred since August 2017.