Cyber Security, Association of Banks discuss accreditation regulations

The Cyber Security Authority (CSA) has held discussions with the Ghana Association of Banks (GAB) on issues of licensing and accreditation regulations.

Advertisement

This followed the commencement of licensing of cyber security service providers and the accreditation of cyber security establishments and professionals on March 1, 2023.

They are, therefore, dialoging on the importance and benefits of regulations being implemented by the authority, especially for the banking sector.

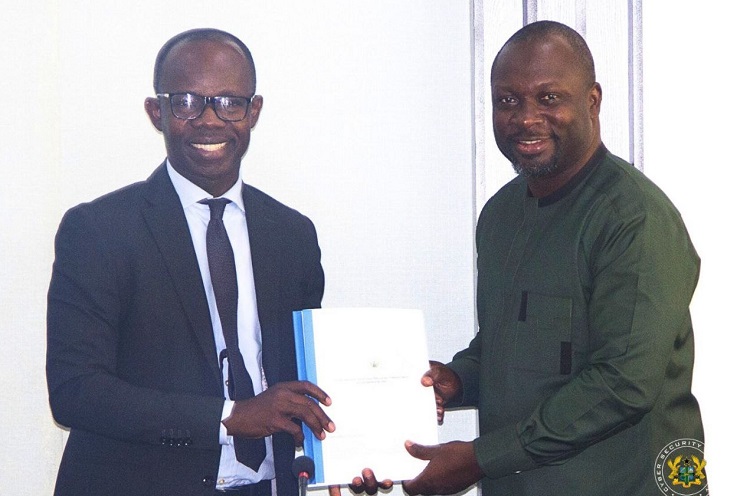

Leading the discussions were the Director-General of the CSA, Dr Albert Antwi-Boasiako, and the Chief Executive Officer of the GAB, John Awuah.

Sensitisation

Dr Antwi-Boasiako said the meeting, which was primarily to initiate the development of the cyber security industry, needed the support of the association to sensitise its members to the ongoing licensing and accreditation regulatory exercise to safeguard critical information infrastructure and also protect gains made in the sector.

He said without the right regulatory environment, the banking industry, which was one of the most cyber-dependent sectors, could be crashed by criminals and other malicious actors at the click of a button.

Dr Antwi-Boasiako, therefore, said there was the need for understanding and collaboration among industry players to prepare properly for the regulatory regime.

According to him, the regulatory exercise would serve as a credibility launch pad for professionals who took up contracts in other countries, provide professional visibility and also serve as eligibility criteria for Industry Forum Membership, among other benefits.

He added that the banking industry, one of the largely compliant sectors, was highly prone to attacks due to the surge in online activities.

Dr Antwi-Boasiako said the regulatory interventions would foster information sharing within the industry and oblige the sector to ensure proper cyber security practices in their operations.

He also said that the country was well positioned to serve as a trailblazer for other countries on cyber security.

Information assets

The parties further acknowledged the significance of securing information assets in the financial industry that had been designated as the Critical Information Infrastructure sector under Section 35 of the Cyber security Act, 2020 (Act 1038) and Gazette Notice No.132, dated September 23, 2021.

It recognises the CSA as the lead public agency overseeing the development of cyber security in the country.

Mr Awuah expressed gratitude to the Director-General of the CSA for leading a positive change in the sector, and assured him of the support of the banking industry.

He said the regulatory process of the CSA was one way of creating proper entry barriers to safeguard the banking ecosystem, especially licensing and accreditation of cyber security establishments and cyber security professionals.

According to Mr Awuah, the exercise by the CSA was an important step to safeguard the digital infrastructure of the country, particularly the banking sector, and to ensure that cyber security services were provided by qualified and competent individuals and organisations.