GUTA lauds commitment to good tax regime

The Ghana Union of Traders Associations (GUTA) has commended the government for demonstrating enough commitment to implement good tax regimes to improve on the economy.

According to the association, the 2020 Budget Statement presented to Parliament by the Finance Minister, Mr Ken Ofori-Atta, last Wednesday showed that the government was focused on reforming the tax system.

Advertisement

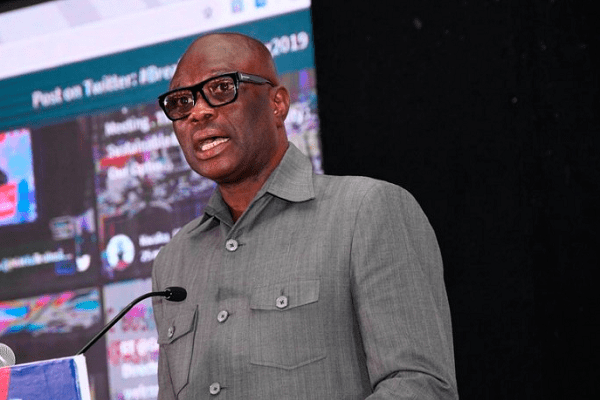

The President of GUTA, Dr Joseph Obeng, told the Daily Graphic in an interview yesterday that the government’s decision to maintain the 50 per cent reduction in the benchmark value for imports was a bold move that would help businesses to thrive.

“The fact that the government maintained the 50 per cent reduction in the benchmark value, in spite of the challenges, makes me happy. Maintaining the benchmark value at a time most of our capital is locked up in the banking sector crisis is good for us,” he said.

Meanwhile, scores of traders who interacted with the Daily Graphic indicated that they were not aware of the budget reading in Parliament, saying that their main concern was to sell their wares.

A couple of them, nonetheless, confirmed watching the presentation on television and also following some of the issues.

Tax expansion

Although the 2020 budget did not introduce new taxes, the Finance Minister gave indications that efforts would be made to expand domestic taxes from 13 per cent of GDP to 20 per cent to rope many people into tax payment.

Dr Obeng said the decision to expand the domestic tax net was a step in the right direction, since it would relieve the few Ghanaians who paid taxes of the burden.

Read also

No new taxes in 2020

Ursula wants profits on ‘momo’ transactions taxed

GUTA locks up 'foreign' retail shops at Opera Square in Accra

Closure of Nigeria-Benin border affecting trade – GUTA

“We have always sought for parity when it comes to tax payment. Our tax payment is such that only 1.2 million of the six million taxable population are paying tax, so we have always wanted it to be spread because it will bring many people into the tax net and relieve us of the burden of paying more when others do not,” he stressed.

Tax exemptions

He, however, said the government needed to be firm and categorical on its position on the tax exemption regime and let the public know how revenue losses through exemptions would be curtailed.

“We wanted the government to be categorical in the review of the tax exemption policies that are being abused. We are talking about the current tax exemptions running over GH¢5 billion per annum and saying that it is too much, especially when it is evident that they are being abused. They should be reviewed because that will help to shore up government revenue,” he said.

Dr Obeng also said the government needed to take steps to ensure that investments that would be made to support banks as part of the banking sector reforms trickled down to depositors.

He also said the declaration in the budget of 2020 as the year of roads was a good move because improved road infrastructure would help boost businesses.

Traders’ concerns

Meanwhile, a visit by the Daily Graphic to the Agbogbloshie Market in Accra to test traders’ understanding of the budget showed that they had little knowledge of the economic exercise.

Rejoice Lavinia Eklu & Justice Agbenorsi report that scores of traders they interacted with indicated that they were not aware of the budget reading in Parliament, saying that their main concern was to sell their wares.

According to them, what mattered most to them were bread and butter issues and not the “big English” that politicians used to describe the economy.

A tomatoes seller, who gave her name only as Mansa, said she had not heard about the budget presentation and had never followed previous budgets read in the country.

She said she only noticed changes in transport fares and the prices of foodstuffs and other items.

“Even when we hear about it, nothing changes. We only notice that prices of things keep increasing and our roads are in a bad state. Nothing is being done about them, in spite of the countless complaints,” she said.

Majority of the traders who were hesitant to give their names said in spite of several calls to fix the bad roads and reduce taxes on food items, the government paid no attention to their concerns.

One of the traders, known only as Sophia, said: “Nobody listens to our plight anytime we cry out to the government and it is as if we are not part of the country.”