The Mirror's Health , Lifestyle and Fashion

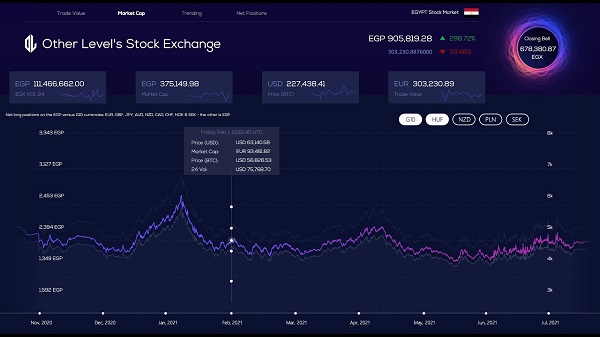

Taking stock

In fact, if you made “New Year” resolutions at the start of 2022, this exercise will be very useful to you. So, come along with me!

Where shall we begin? Of course the beginning of this year’s adventure, which is January 1!

Advertisement

At the start of the year, the general mood of the global economy was mixed, as there were no clear lines to depict a smooth sailing ride after a difficult 2021.However, the mood was tilted favourably towards a rebound in economic activities, albeit with some uncertainties as a few fault lines could be spotted. In fact, my first edition of this column in 2022 was published on January 8, and the screaming headline was: “Uncertain certainty?”

Perhaps, a few lines in that edition would help, so here we go: “Welcome 2022! It is just a week into the new year, but l am sure you would be able to provide some guidance on what we should expect this year, wouldn’t you? I bet you would. I am sure all your sentences would have some strong inferences to the pandemic, and how its containment in the coming months was key to the outlook for growth. Of course, certainly this is the common sense approach, because we are in the second anniversary of the COVID-19 pandemic, and yet there are still doubts as to whether we would be able to effectively deal with the scourge once and for all”.

The doubts about the pandemic, unfortunately persist, despite the fact that the vaccines have brought hope. But the other sad reality is that as the global economy seemed to be on the path of strong recovery in the first quarter of 2022, albeit at a much slower rate than anticipated, the world had to face prospect of war in eastern Europe. The Russia/Ukraine conflict has, and rightly so, caused jitters in the global economy.

This conflict has exacerbated the severe global supply chain disruptions caused by the pandemic-induced restrictions, resulted in unexpected rise in inflation globally due to supply side restrictions, which has caused a rise in both food and non-food components of the inflation basket, and tight labour market conditions; all weighing on growth in most emerging and advanced countries’ economies. There are record levels of inflation rate in the Eurozone, the UK and the US. Of course, this has forced policymakers to respond to the threat by introducing interest rate hikes. Some were unexpected, but mostly it has been an uncertain certainty because of the economic dynamics.

So, what has been the impact of all these on individuals and households? At the start of the year, we all had good hopes for the global economy because of the strong resilience it had shown, despite the health, economic and social havoc caused by the spread of the coronavirus, which was effectively declared “pandemic” in 2020. The onset of the pandemic was really scary, with heightened uncertainty and unexpected slowdown in global economic activity, ostensibly caused by the unintended consequences of the mitigating measures introduced to contain the virus. That was more like suffering from the side effects of a potent drug that was expected to help you control a debilitating ailment! The worst seemed over in 2021, so we raised our chest high to welcome 2022!

Well, this half-year stock-taking is to remind us all of the uncertain nature of life in general, and why there is the need for a pause-and-reflect attitude to everything we do.

As I explained in the July 11, 2020 edition of this column, since the creation of man, there is always a period where everything would seem to be moving in the right direction, and also odd times when nothing worked. There are ups and downs, harvest and lean seasons, dry and rainy seasons. In our world, these distinct periods of high and low economic activities, marked as boom-bust cycles, generate the buzz effects. It has been a regular feature of economic life.

In the 1980s, for example, the world economy experienced the damaging effects of the boom-bust cycle. There were periods of sustained increase in asset prices and generally improved global economic and financing conditions. But all came down again, leading to tight financing conditions. Following the 80s were periods of economic boom, largely supported by growth in technology innovation, its development and adoption. And a bust too!

Now let me take you to some of the words l used in the January 15, 2022 edition of this column to depict why the uncertain times should rather spur you on to do more. “First off, remember that perfect conditions are rare. Yes- rare- so if you are waiting for conditions to be perfect before you make a move, you will never get started. And the beauty here is that, again, there are great stories about legends that depict why those who dare always succeed, and the fearful always find it tough staying afloat”.

As you can see, the reality in the half-year has been less romantic, but be comforted by the words of William Shakespeare, as repeated in the January 15 edition: “In Coriolanus, William Shakespeare demonstrates why we need to have the strength to deal with situations, regardless. …he wrote: ‘when the sea was calm all boats alike / Show’d mastership in floating’.

“Clearly, what Shakespeare seeks to point out is that we can all claim some level of fortitude when we have not been put to test. The sea is not always calm and so we will always have people who will become pessimistic about situations- situations such as how the COVID-19 pandemic has devastated our social and economic life thus far”.

You have to be alert, at all times, to be able to spot facts from fiction. It is a fact that the pandemic has crippled many aspects of our life, and the war in eastern Europe is having economic toll on the global economy as well, but it becomes fictional play when you deem the situation as hopeless.

You shouldn’t be daunted by the challenges of the past six months because there is nothing new under the sun. Stay focused on your plan, do your best and luck will find you! Let me repeat here again that many of the successful companies that you find today were all built in periods of economic downturn: Microsoft, Apple, Disney, CNN, Fortune magazine, GE, Hewlett Packard and many more. It is our ability to understand complex ideas, adapt effectively to the world, learn from experience, engage in various forms of reasoning, and overcome a wide range of obstacles that make us humans.

[email protected]