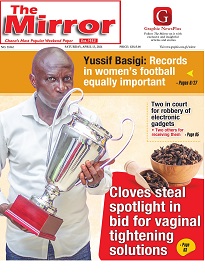

The Mirror's Health , Lifestyle and Fashion

Ghana’s debt burden

“Fifty-Four countries that are home to more than half of the poorest people on the earth planet, need urgent debt relief now,” the UNDP emphasised in the paper.

Advertisement

Titled: Avoiding Too Little, Too Late On International Debt Relief, the UNDP paper asked wealthy nations to step up their efforts to alleviate the debt burdens of poor nations.

“Without action, poverty will rise and desperately needed investments in climate adaptation and mitigation will not happen.”

‘’Rich countries have the resources to end the debt crisis,” the paper added.

On “Why debt restructuring cannot wait until interest rate drops, or a global recession occurs”, the paper stated: “Debt relief would be a small pill for wealthy countries to swallow, yet the costs of inaction are brutal for the world’s poorest’’.

The UNDP administrator, Achim Steiner, has noted: “We cannot afford to repeat the mistake of providing too little relief, too late, in managing the developing-economy debt burden.”

According to the UNDP paper, conditions were ripe for creditors to kick-start debt restructuring talks under the G20 Framework.

It is the position of UNDP that the “rich countries have the resources to end the debt crisis – since the rapid deterioration of debts of poor nations was partly due to their own domestic policies’’.

The paper mentioned some conditions which it believed were favourable for negotiations.

It said debt relief could be done under the G20 Framework established by the Group of 20 (G20).

G20 is an umbrella body for the world’s wealthiest nations.

The paper recommended the way forward that focused on key areas, such as “debt sustainability analysis; official creditor coordination; private participation and use of state contingent debt clauses that target future economic and fiscal resilience”.

According to the UNDP, “effective debt restructuring is only one vital element of ensuring development countries have sufficient finances to achieve progress of sustainable development.”

The Common Framework mentioned in the UNDP paper is defined as a “mechanism designed to provide a swift and comprehensive debt overhaul to nations buckling under debt burden as after COVID-19 economic shock, that will reach beyond temporary debt payment moratorium”.

What is debt restructuring?

Debt restructuring involves “changing the terms of sovereign debt to make paying debt service more manageable”.

It could involve changing maturities; adding grace periods or more time for payments; reducing the principal amounts of the debt; reducing the interest rates; debt service suspension and others.

What is the Paris Club?

It is an informal group of creditor countries.

Their goal is “to find sustainable solutions to sovereign debt payment difficulties”.

What is Debt Service Suspension Initiative (DSSI)?

DSSI is a mechanism that was introduced and endorsed by the G20 finance ministers and the World Bank Development Committee in April, 2020.

It was meant to provide liquidity to countries affected by the Covid-19 pandemic financial shock.

In effect, it provided temporary debt relief to poorest countries that are indebted to G20 bilateral creditors.

Some 48 out of 73 eligible low and lower middle-income nations had their debt payment, due to G20 creditors, postponed until the DSSI expired in 2021.

What is Common Framework for Debt Treatment?

It is a “partnership between G20 and the Parish Club that sought to restructure sovereign debt grounded in traditional Parish Club terms” that is directed at stretching debt relief to poor countries beyond the expired DSSI mechanism.

“This framework allows creditor countries to negotiate together with DSSI-eligible debtor countries on debt treatment.”

At their meeting in Bali, Indonesia, from November 15 to 16, 2022, the G20 leaders in a declaration, known as the G20 Bali Leaders’ Declaration, pledged to implement debt restructuring for poor countries through the Common Framework.

In paragraph 33 of the Declaration, the G20 leaders stated: “At this juncture, we reiterate our commitment to step up our effort to implement the Common Framework Debt Treatment beyond the Debt Service Suspension Initiative (DSSI) in a predictable, timely, orderly and coordinating manner.”

“We are concerned about the deteriorating debt situation in some vulnerable middle-income countries.”

“These could be addressed by multilateral consideration that involves all official bilateral creditors to take swift action to respond to their request for debt treatment.”

“We share the importance for private creditors to commit to providing debt treatment on terms, at least, favourable to ensure fair burden sharing in line with the comparability of the treatment principle,” the G20 Bali leaders’ Declaration added.

From the foregoing, it is clear that Ghana’s high indebtedness does not mean that the world has ended for Ghana as -- some Ghanaian politicians and experts wanted Ghanaians to believe.

There are opportunities for Ghana to get its debts treated in accordance with the Common Framework principles, and others.

Zambia, Chad and Ethiopia are African countries that have had their debt treatments concluded with the support of the IMF.

Ghana has applied to the IMF for a $3 billion credit facility.

That programme involves debt restructuring. Does it include debt treatment as spelled out earlier in this article?

Besides the resort to IMF for the $3 billion credit, what other opportunities are available to enable Ghana ease its huge debt burden that stands at over GHC400 billion?

For debt treatment and debt relief, I believe Ghana can benefit from the various instruments available to get its debts treated in a way that the country would not be overburdened by the debt problem.

It is worth noting that of the 39 countries that are highly indebted and poor, 34 are in Africa.

Debts of African, and some other developing countries, have increased drastically from 2020 and after, because of the COVID-19 pandemic that almost erased gains made in poverty reduction.

The Russia-Ukraine war and high crude oil prices flared up inflation. The war disrupted grain, fertiliser and cooking oil supply to the world market and African nations were among areas badly affected.

Email: [email protected]