Nigeria’s central bank to tighten monetary policy further

Fitch Solutions forecast that the Central Bank of Nigeria (CBN) would continue to raise its policy rate to 19.00 per cent by end-2023, after it hiked by 50 basis points (bps) to 18.00 per cent in March.

Advertisement

Consumer price inflation will remain uncomfortably high over the coming months, driven by elevated food prices, incentivising the central bank to tighten monetary policy further.

That said, weakening economic fundamentals and pressure on Nigeria’s fiscal account will discourage the CBN to raise the policy rate beyond 19.00 per cent.

Hawkish language from Nigerian policymakers has led us at Fitch Solutions to revise our end-2023 policy interest rate from 18.00 per cent to 19.00 per cent. As we had anticipated, the Central Bank of Nigeria (CBN) increased the interest rate by 50bps to 18.00 per cent at the March Monetary Policy Committee (MPC) meeting (see chart below).

The pace of monetary tightening has slowed (for the first time since the start of the current tightening cycle, the CBN hiked by less than 100bps). Even so, CBN Governor Godwin Emefiele struck a more hawkish tone than we had expected, saying in a press conference that the central bank 'plans to continue to tighten, albeit moderately'.

Monetary tightening cycle not over just yet

We anticipate that the CBN will hike its policy rate by another 50bps to 18.50 per cent at the upcoming MPC meeting in May. Consumer price inflation will remain above target over the coming months, incentivising the central bank to tighten monetary policy further. Price growth accelerated from 21.8 per cent in January to an 18-year high of 21.9 per cent year-on-year (y-o-y) in February –– primarily driven by rising transport and food prices (see chart below).

Elevated Food Prices

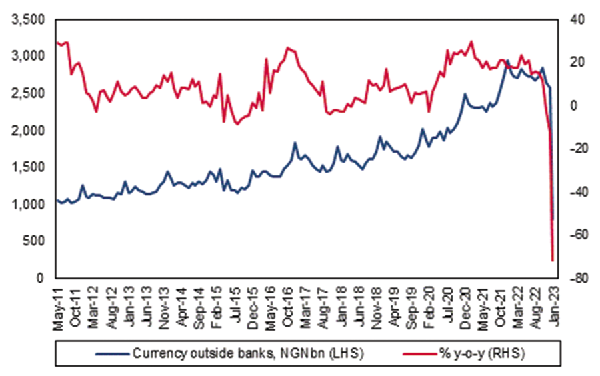

We believe that the demonetisation of high-value naira notes will have a limited impact on inflation in the coming months. While currency outside banks fell by over 70 per cent y-o-y in January (latest available data; see chart below) as a result of the demonetisation policy, we expect inflation to remain high in the coming months.

Weak domestic food production caused by rampant insecurity and the impact of widespread floods in 2022 will keep food price growth – the key driver of inflation (see chart above) – strong and add upside pressure to headline inflation.

As such, we forecast that inflation will average 19.6 per cent in 2023, more than double the ceiling of the CBN’s 6.0 - 9.0 per cent inflation target range, resulting in the MPC retaining its hawkish bias over the short term.

Demonetisation policy to have limited impact on inflation

We believe that the CBN will hike by another 50bps in July. We expect that policymakers will want to see a sustained disinflation path before concluding the current monetary tightening cycle. Indeed, Governor Emefiele has indicated that he is seeking to establish positive real interest rates. Since we expect that inflation will still be around 20 per cent y-o-y in July, another hike is very likely.

There are two key reasons why we think that the CBN will keep the policy rate on hold for the rest of 2023. First, weakening economic fundamentals will discourage the MPC from tightening monetary policy beyond 19.00 per cent.

The demonetisation of high-value bank notes has resulted in acute cash shortages, which have disrupted commercial operations. Nigeria’s purchasing managers’ index plummeted to 44.7 in February (see chart below), from 53.5 in January (values below 50.0 indicates deteriorating business conditions). Given a struggling oil sector and strong price pressures, we project that GDP growth will ease from 3.1 per cent in 2022 to just 2.3 per cent in 2023.

Second, weakening fiscal metrics will also disincentivise the CBN to hike further.

Aggressive monetary tightening in developed markets in 2022 and risk-off sentiment have increased borrowing costs for Nigeria’s government, with Eurobond yields remaining elevated.

Domestically, the CBN’s tightening cycle means that local borrowing has also become costlier.

With Nigeria’s fiscal deficit set to widen from 4.6 per cent of GDP in 2022 to a 24-year high of 5.2 per cent of GDP in 2023, raising interest rates further would worsen public finances, something we believe the CBN will seek to avoid.

Risks To Outlook

There are substantial risks to our interest rate forecast. As a result of cash shortages following the CBN’s demonetisation policy, supporters of President-elect Bola Ahmed Tinubu have called for the outgoing president to dismiss the CBN Governor.

This suggests that tensions between the executive power and the central bank may increase when Tinubu is sworn into office on May 29. If the new president does dismiss Emefiele, the appointment of a new governor could result in a shift in monetary policy. — Fitch Solutions