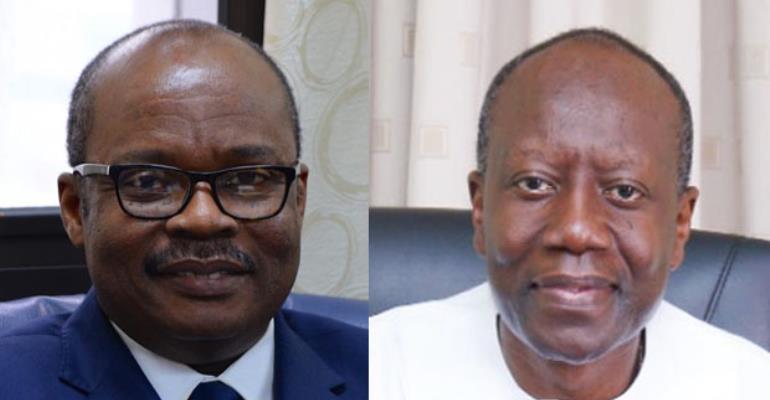

Managing public confidence, credibility • BoG vs Ministry of Finance

Since December last year, the Government through the Ministry of Finance has been embroiled in intense debate and sharply divided on political lines on pushing the proposed electronic transactions levy, commonly referred to as the E-levy.

The majority of the Ghanaian public, spurred on by the political opposition, and largely supported by the media, is rejecting its implementation despite several unfolding events, such as the downgrading of Ghana’s long-term sovereign debt ratings by both Fitch and Moodys since the beginning of this year.

Advertisement

This is because, over the past few months, government has found it increasingly difficult to convince the Ghanaian public to accept some economic policy decisions.

Even the series of town hall meetings organised by the Finance Ministry has failed to win the public opinion on the need for the introduction of the levy.

The media has largely focused on the opposition of attendees to its introduction than on the arguments of government as to why it should be introduced.

While the E-levy controversy is the most intense public economic policy debate in recent times, it is not the only one; simply put, government is losing the faith and confidence of the public to such a dire extent that even its best laid out plans and policies are being belittled.

This is making economic management increasingly difficult, especially with regard to achieving direly needed fiscal consolidation and consequent reversal of Ghana’s current public debt trajectory.

But the Ministry of Finance only has to look to its neighbour, the Bank of Ghana (BoG), for ways in which it can take the public along with such policy initiatives as willing participants.

The ministry just needs to take a leaf out of the BoG’s own play book. It is instructive that even as the Ministry is being subjected to heavy criticism, the general public continues to applaud the Bank of Ghana’s recognition as the best central bank in the world for the past two successive years.

Indeed, the BoG has been recognised for its exemplary conduct and performance locally, just as it has been acknowledged internationally.

But an essential ingredient behind this recognition at home – where the adjudging public is nowhere near as technically knowledgeable as those who conferred the BoG with its awards, – has been its ability to effectively communicate its actions and the rationale behind them to the public using the financial/economic journalists.

Instructively, this has enabled the BoG to retain or adjust its Monetary Policy Rate every two months without protest from the media and subsequently wider stakeholders. It has also enabled it to manage inflation expectations and exchange rate expectations, thus, engendering public confidence towards price and exchange rate stability.

In similar fashion, it has enabled the public to retain confidence in the commercial banking industry and the other genres of financial intermediation after far reaching regulatory reforms saved those industries from collapse.

To do this successfully, the central bank has adopted a three-pronged strategy.

BoG’s strategy

First and indeed most importantly, the BoG has endeavoured to thoroughly train a critical mass of financial journalists in the issues that it addresses, ranging from inflation targeting, through the factors considered in setting of the benchmark Monetary Policy Rate, to both interest rate management and foreign exchange rate management.

Here, the central bank has used major media groupings such as the Journalists For Business Advocacy (JBA) in particular to ensure that the training it sponsors and conducts benefits those journalists who have the best aptitude and fundamental technical knowledge of monetary policy issues, since they are very technical in nature.

The second pillar is the open door policy operated by the top management of the BoG. It is instructive that the Governor and both his two deputies enthusiastically field questions from journalists at the press conferences that follow the meetings of the Monetary Policy Committee every two months.

They also willingly field more questions in the aftermath of the meetings, often hosting some journalists in their respective offices after the press briefings. So do some other senior officials of the central bank, such as the Head of Research, with the approval of the executive management.

Thirdly, the BoG’s Communications Department facilitates the answering of media enquiries as to policy initiatives and their implementation, at all times.

The social media handles of the central bank is also very active and interactive with different stakeholders and getting feedback as well.

Feedback and response

Indeed, the Governor, Dr Ernest Addison, has always ensured that questions submitted formally in writing are almost always answered in most timely fashion, either through written replies based on information provided by the relevant official in the bank or directly through interviews with such persons, again facilitated by the Communications Department.

Crucially though, both the quality of the questions and the quality of the reportage of the answers have been raised by the knowledge imparted to journalists at the training programmes.

This enables the most pertinent questions to be asked and answers to be given that are technical and accurate, provided with the confidence that they will be correctly analysed and reported.

The resultant technical understanding by the financial media of the most technical issues enables the journalists to explain BoG’s actions to stakeholders and the wider general public accurately and in relatively simple terms that make the explanations accessible to all.

Right mix

Of course, this strategy can only work when the institution applying it devises the right strategies and applies them correctly.

The result is that financial journalists and BoG officials have developed confidence in each other and the resultant free flow of information, and the accurate reportage of that information has been crucial in enabling the public to understand the policies and the rationale behind them.

The Ministry of Finance would do well to learn from the BoG’s strategies in this regard so as to get similar results.

If it does, the crisis of public confidence it currently faces would be greatly minimised, especially if it gets its policies right all the time in the same way the BoG does.