Debt exchange exercise requires more clarity — Deloitte

The government’s debt exchange programme launched in Accra yesterday will bring some certainty about what will be done to the country’s domestic debt. A Senior Manager of Financial Advisory, Deloitte Ghana, Dennis Brown, has told the Graphic Business.

“The announcement on its own brings some certainty about what government intends to do with its domestic debts going forward, which is good for investors for purposes of planning and decision making.

Advertisement

“However, some clarity is still required on whether investors will have the option of immediately liquidating their investments or will be forced to roll over onto the new programme.”

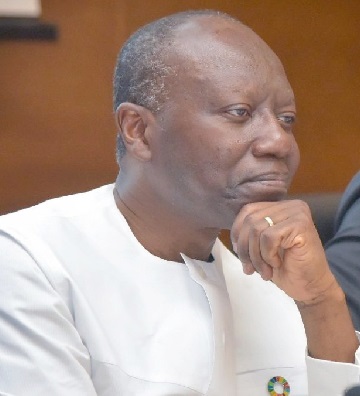

Reacting to the Finance Minister Ken Ofori Atta’s pronouncements at a news conference in Accra yesterday, Mr Brown said: the “Government’s clarification on this will bring further certainty.”

He said all things being equal, with the reduced coupon rates, investors’ interest in the domestic bonds was likely to dwindle, which might adversely impact the government’s ability to raise domestic loans.

“In particular, the situation can become dire should the current high inflation persist into the short to medium term as investors will be extremely concerned about earning interest on their investments that is lower than inflation,” he said.

Impact on foreign investors

For many months, the government has been tight-lipped on what it intends to do with foreign investors who hold government bonds.

The lack of communication on the way forward has forced many foreign investors to be alert as they await an announcement on what the government intends to do next to bring its debts to sustainable levels.

On whether the government’s intended action would impact foreign investors, Mr Brown replied in the positive saying: “To some extent, yes, foreign investor confidence will be impaired given that they are dealing with the same investee, that is, the government, which has admitted to inability to meet contracted terms on existing domestic debts.

“In this case, foreign investors will be worried about the government’s ability to meet their obligations to them.”

Guarantees to ensure stability

There have been arguments to the extent that the new direction taken by the government will not result in economic stability as anticipated by the government.

That assertion is confirmed by Mr Brown who said: “There are no guarantees that these will restore stability in the short to medium term as there are other economic factors that will also play out, favourably or unfavourably.

“However, assuming all other economic factors turn out favourably and domestic bondholders accept and respond positively to the programme, it has the potential to moderate government interest expense and overall expenditure, as well as improve cash flows for investment to drive growth in key sectors of the economy.”

He added that the programme could, therefore, contribute notably to getting the economy back on track.

Haircut

In his last address to the nation, President Nana Addo Dankwa Akufo-Addo assured Ghanaians that there would be no haircut on their investments, an assurance that brought some major relief to investors holding domestic bonds.

However, the situation seems different albeit, not clearly mentioned in the announcement by the Finance Minister yesterday.

Against this background, when asked as to whether the government’s action on the domestic bonds constituted a haircut, Mr Brown said; “It is an inherent haircut as existing domestic bonds will have been contracted at certain terms--coupon rates and tenure, which determine their value based on projected future cash flows.”

According to him, with the reduced coupon rates and the changes in tenure, a revaluation of these domestic bonds based on the newly proposed terms would result in lower values compared to valuing the same bonds based on the existing terms.

“So whilst the traditional haircut will reflect a certain per cent being directly shaved off the principal or interest accrued or both, this approach is likely to reduce the intrinsic value of the existing bonds; hence, an inherent haircut.