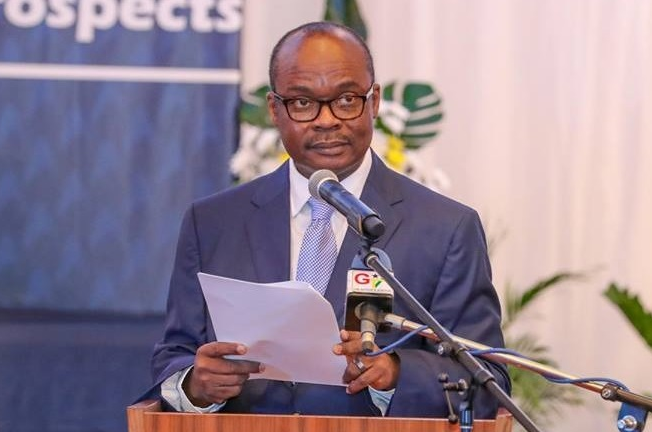

Bank closures costing me life-time friends – BoG Governor

The Bank of Ghana (BoG) Governor, Dr Ernest Addison, says he has had a tough time cracking the whip on underperforming banks in the country, explaining that the aftermath of the decision risk threatening the loyalty of his friendships.

Advertisement

Dr Addison and Mr Asafo-Adjei were mates at the Cambridge University in

No personal feelings

Painting a scenario that suggested how difficult it was for him, the governor told bank executives at the annual Ghana Association of Bankers (GAB) luncheon on August 3 that after BoG had publicly withdrawn the licences of the five banks on August 1, including that of the Royal Bank, he reached out to Mr Asafo-Adjei, asking him not to take the action

“You know the MD of Royal Bank has been my friend since we were mates at Cambridge,” he told the gathering of bank executives at the programme.

“We used to drink beer on Friday nights. So, when this happened, I sent him a text message and said I hope you have not taken this

He, however, assured that the central bank will continue to take relevant decisions to help repose public confidence in the banks and strengthen the financial sector and the economy at large.

Painful decisions

On August 1, Dr Addison said at a news conference that the central bank had withdrawn the licences of the Royal, Construction, BEIGE, uniBank and Sovereign banks for breaching various regulatory rules.

It subsequently approved a purchase and assumption (P&A) agreement for Consolidated Bank Ghana Limited to takeover some assets and all liabilities of the five erstwhile banks under an arrangement that will cost the country some GH¢5.76 billion.

The withdrawal of the licences was the second of its kind in 12 months. In August last year, the BoG withdrew the licences of UT and Capital banks for insolvency and approved a similar P&A agreement for GCB Bank to

That deal cost GH¢2.2 billion.

While admitting the painful nature of the decision, the Director of Banking Supervision Department of the BoG, Mr Osei Gyasi, said in an interview that “management thought that was the best decision to take under the circumstances.

Asked if the decision took into consideration the cost implications, Mr Gyasi said the considerations covered everything and it was agreed that “that was the best in terms of everything.”

Like Dr Addison, Mr Gyasi said it was not an easy decision to take although necessary for the strength of the entire financial sector.

“As a regulator, sometimes you are like a doctor and you know how doctors feel when their patients die, right?

“

“Now, you can just imagine how the doctor feels. It is the same way we also feel; we don’t take delight in seeing banks go down but sometimes, you do all you can but you will just have to take the appropriate decisions.

“That is how we feel; we are not happy but our work is to ensure that we have a vibrant and robust financial sector,” he added.