Veep calls for expansion of access to financial services

The Vice-President, Dr Mahamudu Bawumia, has reiterated the need for a paradigm shift in the offering of financial services to help deepen financial inclusion in the country.

He said although there were many institutions providing financial services, the reach was low, hence the need to use technology to deepen access and encourage people to use those services.

“We really need a paradigm shift in the area of financial inclusion because what is clear is that there are many financial institutions but we still have a very large segment of our population unbanked,” he said.

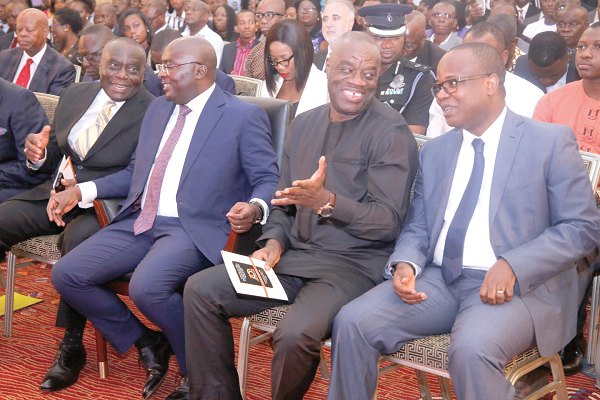

Dr Bawumia was speaking at the launch of the 10th anniversary of Bond Savings and Loans Plc in Accra.

Bond is a deposit-taking, savings and loans company.

Government is committed

“We have seen a lot of financial institutions but the depth in terms of coverage is not there and this is why we really need this paradigm shift. This shift is going to come in terms of mindset and the use of technology that allows us to reach the unbanked of the population,” the Vice-President noted.

He stressed that financial inclusion and the formalisation of the economy remained a key vision that was dear to the heart of government.

“We have been pursuing the agenda of greater financial inclusion and formalisation of the economy in many spheres,” he said.

He said the government would continue to provide the soft infrastructure needed to ensure that financial inclusion was deepened in the country.

“Government will, therefore, give the needed support to help the sector perform this critical role of mobilising savings and channelling funds into households, micro, small and medium-size enterprises which need these funds to expand their businesses and to create jobs,” he added.

Bond #@ 10

Recounting the success story of Bond Savings and Loans Plc, the Chief Executive Officer, Mr George Ofosuhene, said from humble beginnings of starting the operations with a single office and 10 members of staff, Bond could now boast 12 outlets and over 150 members of staff delivering excellent customer services.

In terms of clientele base, the company now had over 10,000 customers from an initial 10 when it started business 10 years ago, he said.

“We have, within this span of years, truly asserted ourselves and assumed our place in the industry as a leader, key player and worthy competitor.

“We have served with distinction, impacted positively on the financial services industry, contributed our share to the growth of the Ghanaian economy and, above all, discharged our obligations to the regulator, our shareholders and employees without fail,” he said.

Mr Ofosuhene also acknowledged the role Bond customers had played over the last 10 years and pledged its continued effort to ensure that customers received tailor-made products and services, going forward.

“We believe firmly that our success lies in the continued offer of superior services to customers. Our priority is to ensure that customers feel good about their partnership with Bond. We give our best to make every customer feel that he or she is an appreciated member of the Bond Family, so each product that is developed has the convenience of the customer in mind,” he said.

He said the company remained committed to facilitating the creation of wealth for Ghanaians, both home and abroad, through its products and services.

“I stand here to assure all our customers that keeping you in control of your finances, delivering products that will not only empower but also unleash every brilliant potential will remain a relentless pursuit. Ensuring that your banking experience is made easy and guarded by unsurpassed security will always be our prime objective,” the CEO promised.

New product

Mr Ofosuhene announced that by the end of July this year, the company would start providing bulk payment services to allow customers to make bulk payments to any bank account within the country.

“Bond is earnestly working towards the goal of enabling our customers to access their money from anywhere in the world. Appreciating the fluid nature of future banking needs, we are constantly working to improve all our products and services,” he said.

For merchant customers, he said, the company was currently working at introducing the Bond Collect Service, which would allow them to collect funds through any electronic channel, Bond branch or cash centre.

Mr Ofosuhene explained that the service would eliminate the risk of carrying a lot of cash and enable merchants to have an increased reach to their customers, making transactions between them a lot easier.