Ecobank Ghana, GN Savings and Loans partner

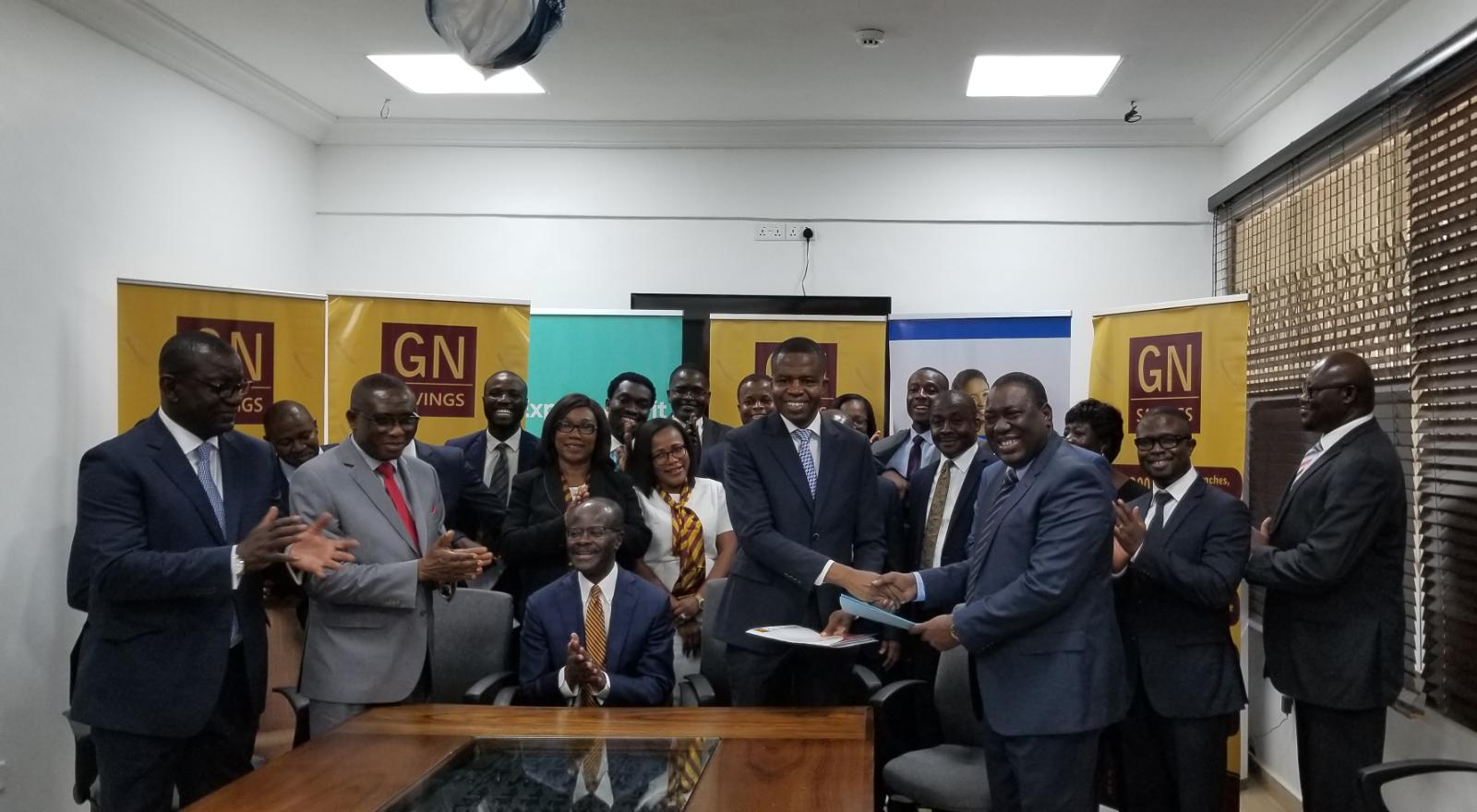

Ecobank Ghana and GN Savings and Loans have signed a memorandum of understanding (MoU) for the establishment of a partnership between the two financial institutions.

The agreement, signed last Friday at the offices of GN Savings, will see the two institutions work together in areas that will be mutually beneficial to them.

Advertisement

The agreement became necessary due to the reclassification of GN Bank as a savings and loans company, now called GN Savings. Savings and loans companies have ‘partner banks’ to serve as their bankers.

At the signing ceremony, the Chief Executive Officer (CEO) of GN Savings, Mr Issah Adam, said “with this partnership signed, we urge our clients and the Ghanaian banking public to continue doing business with us.”

He said with 300 locations nationwide, GN Savings brought on board the widest physical outlets for the distribution of financial services in the country, creating the desired convenience for customers, especially in the rural areas.

Ecobank

For his part, the Executive Director of Ecobank Ghana in charge of Finance, Dr Edward Nartey Botchway, said: “We at Ecobank are happy with the opportunity to provide banking services to GN Savings. The reclassification of GN Bank to GN Savings has resulted in the need for a banking partner for the company,” he explained.

Dr Botchway, who is also the Chief Finance Officer (CFO) of Anglophone West Africa of Ecobank, added that the bank’s superior technology platform and dedicated staff made it the ideal partner to support GN Savings and Loans in that regard.

“For us, this is not just a transaction but a partnership that will serve both institutions well. We believe that this partnership will grow and possibly lead to other forms of strategic alliances in the coming years,” he said.

Witnesses

Present at the ceremony were the Chairman of GN Savings, Dr Papa Kwesi Nduom, the Vice-President of Groupe Nduom, Dr Nana Kweku Nduom; the Chief Operating Officer of GN Savings, Mr Robert Danso Boakye; the Ecobank Head of Commercial Banking, Ghana and Anglophone West Africa, Mr Alfred Sakyi and the Ecobank Head of Branch Network, Madam Adobea Addo.

Others were Ecobank’s Head of SME, Mr Kingsley Adofo-Addo, and Ecobank’s Relationship Manager for Non-Bank Financial Institutions, Mrs Kelda Ofedie Ocansey.

Background

In January, the then GN Bank decided to opt for a savings and loans company status rather than being forced to close down or be part of any arrangement to shore up its capital.

That followed the inability of GN Bank to meet the new Bank of Ghana minimum capital requirement of GH¢400 million.

In order to remain Ghanaian and not allow foreign ownership, the bank decided on that route so that it could continue to serve its customers spread across the country, mostly in the peri-urban and rural areas.

A statement issued in January by the Corporate Affairs Directorate of GN Bank, said: “The decision allows us to concentrate on ensuring maximum liquidity to sustain the business, instead of raising funds for additional capital as a universal bank.”

It added that the bank’s immediate objective was to find the liquidity needed to service the needs of its customers.

“These investors wanted the retail network we have built, but with the intention to abandon our vision of promoting financial inclusion and serving the needs of ordinary Ghanaians.

We have been honest about who we are - a Main Street Bank and not a High Street Bank,” the statement added.

GN Bank attributed its inability to meet the minimum capital mainly to debts it said it was owed by contractors who worked on contracts awarded by state agencies and the government.