Majority, Minority ‘fight’ over budget

The Majority and Minority Members of Parliament (MPs) yesterday slugged it out as they began a debate on the Budget Statement and Economic Policy for the 2017 financial year.

Advertisement

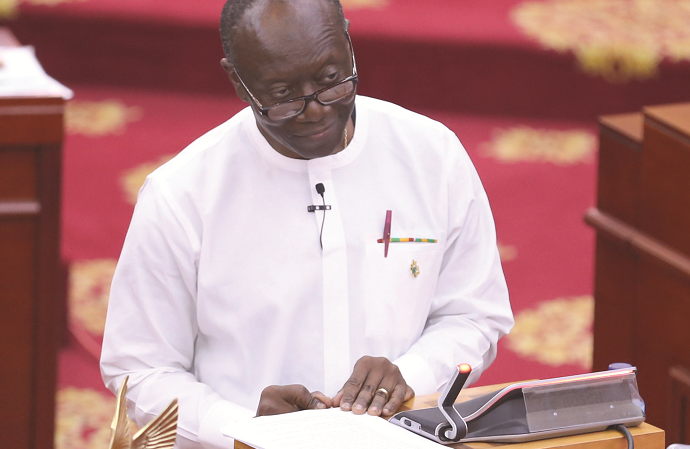

The contention was more on the gross domestic product (GDP) projection, revenue targets, expenditure projections and other indicators captured in the budget presented by the Minister of Finance, Mr Ken Ofori-Atta, to Parliament on March 2, 2017.

As anticipated, the Majority described the budget as a goodwill message that would grow the economy, lower the cost of doing business, support the growth of local businesses and create jobs.

But the Minority described the budget as a deception devoid of actionable measures and policies to achieve the set targets.

The Minority argued that the removal of import duties would open the floodgates for the importation of more goods that would offer unfair competition to locally manufactured goods and consequently lead to the collapse of local business.

Majority's support

The MP for New Juaben South and Chairman of the Finance Committee of Parliament, Dr Mark Assibey-Yeboah, who moved the motion for the commencement of the debate, described the budget as the best budget so far that would move the country out of its current predicament.

He said the budget was concise, business-friendly and people-centered, which had resonated in the country, including Abossey Okai, Tudu, Suame and across the country's borders.

Dr Assibey-Yeboah said the budget, which indicated the government's decision to remove some taxes and reduce other taxes, would lower the cost of doing business, spur economic growth and create jobs.

That, he said, was unlike the National Democratic Congress (NDC) government that imposed taxes on so many areas, including savings, withholding tax, duty on petroleum, and Value Added Tax (VAT) on real estate sales.

Dr Assibey-Yeboah said in 2017, the economy was projected to grow at 6.5 per cent, and indicated that it was the first time in six years that the country would be recording such an economic growth.

He said the $1 million that would be given to every constituency annually would give the constituents the opportunity to determine the sort of development they needed in their respective areas.

Besides, he said, there would be a $219 million stimulus package for industry, and another $219 million for the development of zongos.

Dr Assibey-Yeboah said the one district, one factory project would grow businesses, create jobs and "make Ghana work again."

The MP for Ofoase/Ayirebi, Mr Kojo Oppong-Nkrumah, said the budget focused on five challenges that the government had outlined measures to tackle.

He mentioned the considerable debt overhang and rising interest payment, the expenditure overrun and accumulated arrears, the revenue under performance, growth which was falling and limited capital investment as the challenges.

On the current depreciation of the cedi, he argued that in the first quarter of every year, the cedi depreciated on the average by five per cent.

Minority's criticism

The Member of Parliament (MP) for Ajumako/Enyan/Essiam and former Deputy Minister of Finance, Mr Cassiel Ato Forson, said the budget had serious deficiencies which raised doubts about the attainability of the targets.

Besides, he said, the projections in the budget were disappointing despite the expected growth in the economy.

He said the expected economic growth would be driven by growth in the oil sector by 39 per cent but not through any effort on the part of the government.

For instance, Mr Forson said the agriculture sector was projected to decline from 3.6 per cent in 2016 to 3.5 this year, the education sector would go down from 7.9 per cent in 2016, 6.7 per cent this year, while the health and social services would reduce from 9.8 per cent in 2016 to 5.3 per cent this year.

"I was expecting to see the impact on GDP projections. I did not see anything like that", he said.

The MP for Ketu South, Mr Fifi Fiavi Franklin Kwetey, said the budget had lofty objectives and wondered how the government would be able to walk the talk.

He said the removal of import duties would allow the flooding of the country's market with competitive goods.

That, he said, would defeat the government's objective of unleashing the creative capacity of Ghanaians.

Mr Kwetey, who was a former Minister of Food and Agriculture, said the minister failed to remove duty on raw materials, remove the Energy Sector Levy, or reduce corporate tax from 25 per cent 20 per cent, which were campaign promises.

On the one district, one factory policy, he said "the problem is not about establishing factories, but the issue is about ensuring that the conditions are in place to make them viable."

Touching on the free senior high school (SHS) education policy, Mr Kwetey asked the government to be cautious as the full implementation would require GH¢3.6 billion annually, which would destroy the country's economy.