Would tax cuts induce growth in Ghana - an Assessment of NPP’s Manifesto Promises

Tax revenue is very critical for every economy. Yet, the impact of taxation on growth and investment has remained a hotly debated issue, not only to the academics but to politicians and policy makers as well.

Advertisement

Proponents of tax cuts argue that lower taxes would both stimulate the economy in the short run and increase normal output in the long run through their positive effects on incentives to work, spend, save, and invest. To them, higher taxes hurt the economy by distorting behaviour – reducing work effort, spending, saving, and risk-taking. For example, Romer and Romer (2014), investigated the impact of tax changes on economic activity in the postwar United States (1950-2007). They found that an exogenous tax increase of 1 percent of GDP lowers real GDP by roughly 2 to 3 percent.

In many poor developing countries, a low tax-revenue relative to GDP prevents them from undertaking ambitious development expenditure programmes. Furthermore, due to the inefficient tax administration systems in these countries, tax rates tend to be high and concentrated on few tax payers and on indirect taxes. Mobilising additional resources through new tax regimes, external financial support, and deficit financing to finance budgetary expenditures is therefore a policy priority.

Ghana has pursued major tax reforms over the last two decades. The country moved progressively from a historically high corporate tax rate regime of 65 percent in the 1980s to 32 percent in 2001 and 25 percent in 2006. In 2006, when the corporate tax rate fell to 25 percent, corporate income tax revenue dropped by 3.1 percent while real GDP growth rose by 0.3 percent, (up from 5.9 percent in 2005 to 6.2 percent in 2006) before falling by 1.9 percent in 2007, (down from 6.2 percent in 2006 to 4.3 percent in 2007).

Non-oil tax revenue increased from GHȻ4.2 billion in 2008 to GHȻ23.7 billion in 2015,

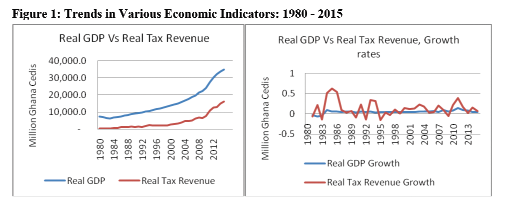

Ghana’s tax system, especially the corporate income tax regime compares favorably with its peers in the lower middle income bracket—the average corporate income tax rate for LMIC is 29.6 per cent compared to Ghana’s 25 per cent. The movement of real GDP and real tax revenue has always been positive, with growth rate higher than the growth in real tax revenue. This explains the fact that the growth rate in real GDP is not strong enough to pull up the growth rate in real tax revenue.

The NPP argues that Ghana has a very high tax regime and that a further reduction in corporate income tax rate and abolition of other indirect taxes could generate substantial benefits to the country. In this spirit, the New Patriotic Party’s (NPP) as stated in its 2016 Manifesto, promises to reduce corporate income tax rate from the current 25 percent to 20 percent and also abolish a host of other indirect taxes, including the following, when it wins the power to govern.

(i) removing import duties on raw materials and machinery for production within the context of the ECOWAS Common External Tariff (CET) Protocol;

(ii) abolishing the Special Import Levy;

(iii) abolishing the 17.5% VAT on imported medicines not produced in the country;

(iv) abolishing the 17.5% VAT on Financial Services;

(v) abolishing the 5% VAT on Real Estate sales,

(vi) abolishing the 17.5% VAT on domestic airline tickets; and

(vii) Reducing VAT for micro and small enterprises from the current 17.5% to 3% Flat Rate VAT

Furthermore, the NPP proposes to pursue some very ambitious development projects. For the purpose of this paper we highlight just four (4) of these projects, namely:

(i) one-district-one factory;

(ii) one-village-one-dam in the northern regions;

(iii) one-million dollars-per-one-district per year; and

(iv) one-extension officer per 500 farmers.

The intent is to stimulate economic growth through tax cuts with the resultant higher output also spurring higher tax revenue.

1.How much does it cost to implement NPP’s proposed policies

To make any meaningful analysis of these policies, it is important to know how much they will cost. Estimating the cost of some of the policies is quite straight forward. Our preliminary estimates show that the proposed reduction in corporate tax rate alone will result in a revenue loss of approximately GHȻ1.4 billion as shown in Table 1. Abolishing VAT on financial services will incur a revenue loss of GHȻ240.6 million. Abolishing the special levy will result in a revenue loss of GHȻ688.1 million while abolishing VAT on raw materials will lead to a revenue loss of GHȻ175.4 million. Table 1 show that six out of the seven proposed tax cuts will result in an estimated revenue loss of roughly GHȻ2.6 billion in 2017 alone.

Now let us look at the development projects. As mentioned earlier, we select only four of those projects for the purpose of this paper. Let’s start with the one-village-one-dam policy. The NPP’s unofficial projection is to construct at least 2,000 dams at a unit cost of $300,000 (myjoyonline, 2016).

This brings the total cost of this project to roughly US$600,000,000 and using an exchange rate of US$1 to GHȻ4, this will amount to GHȻ2.4 billion as shown in Table 2. With regards to the one-district-one-factory policy, available evidence suggests that a factory, depending on the type and size, will cost a minimum of US$7.0 million. Implementing this across the 216 districts will require a budget of at least US$1.5 billion, which is equivalent to GHȻ6.0 billion. Assuming that the one-million dollars per one district policy is to be implemented separately from the above policies, this will give us a straight figure of US$216 million or GHȻ864 million per year.

According to the sixth Ghana Living Standards Survey (GLSS 6), about 51 percent of Ghanaian households are engaged in farming and about 44.7 percent of economically active Ghanaians are engaged in agriculture. Given the total labour force of 11,940,000 (2014 est.), the labour force participation rate of 79.6 percent, and using a conservative agriculture labour force growth rate of 1.23 percent, the total farmers population is estimated to reach about 4.4 million by 2017.

Assigning one extension officer per 500 farmers will therefore, require at least 8,800 extension officers. At an entry salary level of GHȻ1,200, this policy will cost at least GHȻ131.2 million per annum. Thus, using the least cost scenario, it appears that the four policies alone will cost the government roughly GHȻ9.4 billion in one fiscal year, which translate into 12.4billion over the four year period. Of course, some of them are one-time expenditures and are likely to be staggered over the 4-year political cycle or more—the dam and the factory belong to this category. At the extreme, we are talking about roughly GHȻ93 billion for these four projects alone per year, which translate to GHȻ96 for the four year period.

The recurrent component of the four projects alone, namely, the one-million dollars-per-one-district per year and one-extension officer per 500 farmers, however, will amount to just about GHȻ1 billion a year. Over the four year period, this will amount to GHȻ4 billion.

The mean corporate tax rate in Ghana over the period 1990 to 2015 is roughly 30%, while government expenditure to GDP was 20.4% which compares favourably to Ghana’s peers in the middle income category.

Concluding Remarks

This paper examined the effects of taxation policy on economic growth in Ghana. In particular, the paper examined the impact of corporate income tax cuts on economic growth. A set of tax variables and control factors that can potentially influence real GDP growth is considered in the econometric analysis. Our main findings can be summarized as follows: We find evidence of an elastic relationship between tax variables and real GDP growth rate in both the short run and long run. In particular, we find that a 1 percent reduction in corporate tax will cause real GDP growth rate to increase by 3.17 and 2.09 percent in the long-run and short-run respectively. The Generalized Least Square estimate showed that tax revenue is growth inelastic. We also found a bi-directional causality between tax revenue and growth for Ghana, though the causality from growth to revenue is mild.

We also found a positive and robust relationship between government expenditure and real GDP growth rate in the short-run. FDI inflows have a positive effect on real GDP growth both in the short-run and long-run.

Estimates by the tax authorities show that a cut in the corporate income tax rate by 5 percentage points could cost the country roughly GHȻ1.4 billion in corporate taxes alone and over GHC2.5 billion in proposed tax cuts. However, the measure could also improve overall tax revenue by0.416 percent in the short-run.

Considering the heavy expenditure projects being considered by the NPP government, which could cost up to GHȻ93 billion to implement, this paper argues that the NPP [government] would have to resort to high deficit financing in order to finance its budget. And given the country’s commitment to zero central bank financing under the IMF programme, the only options is to the resort to commercial borrowing with its attendant consequences for the economy.

Policy Recommendations

The paper then makes some policy recommendations on how to improve tax revenue without necessarily jeopardizing growth. The NPP [party] may not be able to pursue the proposed tax cut and expenditure programmes simultaneously. It may have to choose one of the two policies at a time. The possible options therefore, are as follows: (1) borrow heavily on commercial terms to be able to implement both policies simultaneously; (2) suspend the tax cuts in order to be able to admit expenditure programmes, (3) suspend development projects in order implement the tax cuts.