The banking crisis: Who governs the governor?

The current topical issue on the lips and minds of almost everyone in Ghana is the collapse of the seven banks as a result of corporate governance failures by the mangers of the affected banks, as well as the regulator.

One of the major reforms implemented after the post-Enron corporate failures in 2001 was the decoupling of the role of the managing director/chief executive officer position from the chairman of the board of directors.

This corporate governance policy position was envisaged and coded by the framers of the 1979 and the 1992 Constitutions of the Republic of Ghana. Article 201(2) of the Constitution (1979), which was repeated in Article 285 of the Constitution (1992) which provides that:

“No person shall be appointed or act as the chairman of the governing body of a public corporation or authority while he holds a position in the service of that corporation or authority.”

The Constitution places a limitation on the same person playing the role of the managing director or chief executive, as well as chairman of the governing body of public corporations or authority. However, the governor of the central bank under Article 183(4)(b) of the Constitution, 1992 is exempted from this constitutional constraint. The said provision stipulates that:

“..the governor of the Bank of Ghana shall... notwithstanding Article 285 of this Constitution be the chairman of the governing body of the Bank of Ghana.”

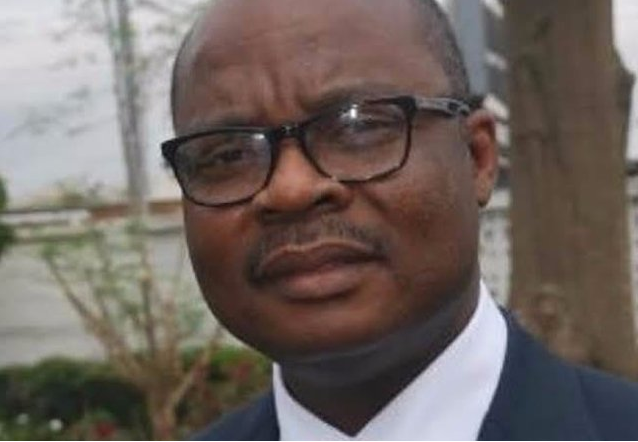

The board of directors of the central bank was under the chairman of the first governor, Mr Alfred Eggleston, as well as the current governor, Dr Ernest Addison. The practice where the governor is also the chairman of the board of directors is not new to Ghana. This is the practice in other jurisdictions, including Nigeria and Trinidad & Tobago.

One will wonder why the governor of the Bank of Ghana is exempted from such control as a result of the critical nature of the role of the central bank, including promoting and maintaining the stability of the currency of Ghana. The depreciation of the Ghana currency against the United States (US) dollar, among others, has financial implications on the prices of goods and services in Ghana. This suggests that the decisions of the governor of the Bank of Ghana affect every Ghanaian. The Bank of Ghana introduced a string of fresh exchange controls in February 2014 to halt the depreciation of the cedi. The Ghana cedis depreciated by 1.2 per cent in the afternoon that the said notices were posted on the Bank of Ghana website.

One of the reforms that should be pursued in the wake of the current banking crisis is the decoupling of the position of the governor of the Bank of Ghana and the chairman of the board of directors of the Bank of Ghana. The decoupling will help strengthen accountability of the governor to the board from the current position where the governor is likely to preside over management decisions in the boardroom. This will also go a long way to strengthen the independence of the board.

Article 183(4)(b) is not an entrenched clause of the 1992 Constitution and Parliament will need two-thirds of all members of Parliament to amend the said provision in compliance with Article 291 of the Constitution (1992).

I am concluding with the words of Mohammed bin Rashid AI Maktoum, the Vice-President and Prime Minister of the United Arab Emirates and Ruler of Dubai, in his book My Vision: Challenges in the Race for Excellence at page 26 where he said: “Change and adapting to a quickly changing reality are inevitable. We do not need the type of change that allows us to catch up or cope with others; we need the type that allows us not only to win the present race but lead the next one. We have spent enough time in the shadow of our past and need to look forward and embrace our plans for the future.”

The wind of reform that is currently blowing at the central bank should not only address the current banking crisis, but should prevent the recurrence of such corporate governance debacles in the future. This is why I am of the opinion that the position of the governor of the central bank and the chairman of the board of directors of the central bank should be decoupled.

Writer’s email: [email protected].