Economic prospects good, but...

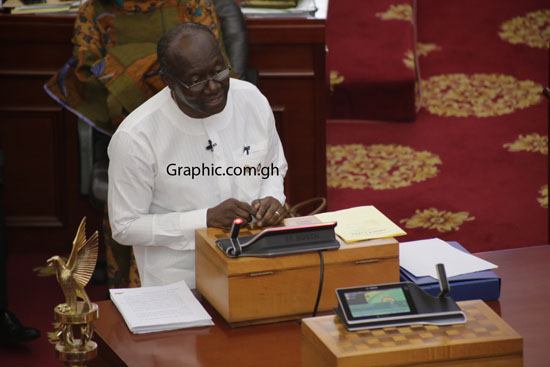

The Minister of Finance, Mr Ken Ofori-Atta, on Thursday presented the country’s projected incomes and expenditure for next year, keeping in tradition with the Constitution to do so on behalf of the President.

The budget projected to consolidate the gains made over the last two years with prudent policies and programmes that will enable the private sector to thrive, while enhancing job creation opportunities.

The Finance Minister chronicled a number of achievements that the government had chalked up in the last 24 months, including creating employment for more than 200,000 young people. The new Ghana Commodity Exchange, he said, was also expected to create about 200,000 skilled and non-skilled jobs.

Since macroeconomic indicators show the aggregate performances of various sectors of the economy, it is always a requirement for budget statements to depict the state of affairs of the economy. Real gross domestic product (GDP), the minister said, grew by 5.4 per cent (using rebased series) in the first half of 2018, compared to the annual target of 5.6 per cent. The figure, without taking oil into consideration, showed a growth of 4.6 per cent, compared to the 2018 target of 5.8 per cent.

End-period inflation rate declined from 11.8 per cent at the end of 2017 to 9.8 per cent at the end of September 2018 and further to 9.5 per cent as of October 2018.

The country, however, spent above its means by three per cent of rebased GDP at the end of September 2018, compared to a target of 2.7 per cent fiscal deficit.

Advertisement

Read Also:Century bond necessary to stop hand-to-mouth existence – Ken Ofori-Atta

Interestingly, the public debt stock, including the financial sector bailout costs, appears to be easing. As of the end of September 2018, the debt was 57.4 per cent of rebased GDP. Excluding bailout costs, the debt was 53.9 per cent of rebased GDP.

The provisional trade balance for the period recorded a surplus of $1.6 billion, compared to a surplus of $777.82 million recorded for the same period in 2017.

Gross International Reserves, which indicate the funding reserve position of the country, had accumulated to $6.76 billion, able to cover up to 3.6 months of imports. The year-end target is to pile up reserves sufficient for 3.5 months of imports.

However, some independent analysts, while commending the achievements have cautioned that the country is still not out of the woods, something the Finance Minister himself alluded to while presenting the budget statement. The analysts maintain that the economic gains must be consistent, robust and consolidated.

It is not time to be complacent. Non-oil GDP growth is projected at six per cent, at a time when the country needs an average growth rate of eight per cent consistently for about a decade to make the economy robust.

The Daily Graphic, nonetheless, applauds the government for such inroads as the Planting for Food and Jobs (PFJ), which has performed so well, in spite of challenges such as the fall army worm invasion. It has also done well for introducing initiatives such as expanding the PFJ to include the rearing of livestock and providing incentives for young entrepreneurs.

We believe that efforts to revamp the railway sector and the Volta Aluminium Company (VALCO) and the fight against corruption to safeguard the public purse are also in the right direction.

The Daily Graphic, however, urges the government to keep its eyes on implementation, as some of the things that were captured in the 2018 budget such as the $1 million per constituency and building dams in villages and factories in every district are yet to be implemented fully.