After raising another Eurobond, what next?

Barely a week ago, the government successfully raised $3 billion in Eurobonds. The bonds were issued in three tranches, with the following terms: $750 million for a 7-year bond issued at 7.875 per cent; $1,250 million for a 12-year bond issued at 8.125 per cent, and US$1,000 million for a 31-year bond issued at 8.950 per cent.

Many reasons might have accounted for the massive show of interest in Ghana’s bond, but primarily the achievement, according to the managers of the economy, was possible because of the country’s strong macroeconomic performance over the past two years and the bright future prospects which were amply confirmed by the capital markets with an unprecedented order-book in excess of US$21 billion, an over-subscription of more than seven times, the largest ever in Africa to date.

Advertisement

The interest rates compare very favourably to the interest rates obtained in the 2018 Eurobond issue, when taking into account the 70 basis points increase in the Federal Funds Rate from 1.700 per cent to 2.400 per cent over the period.

There is no doubt that the results provide compelling evidence of the progress made so far and demonstrate a strong interest in Ghana’s economy from the international investor base. During the process, bids submitted exceeded US$21 billion, compared to the over US$8 billion in bids recorded in 2018.

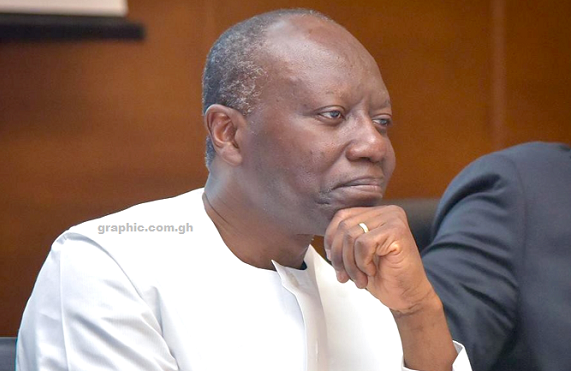

Last week, on a radio programme in Accra, the Finance Minister indicated that part of the money raised would be used to settle some maturing debts to bring down interest payments, while the other part would be used to undertake some infrastructure projects, as captured in the 2020 budget, as well as settle the debt in the petroleum sector. Another area where the money will be applied is to settle, once and for all, the financial challenges faced by depositors of collapsed banks.

The Daily Graphic finds the move made by the government satisfactory, in view of the challenges within the economy which require a lot of funds to fix and also place it on the right footing for a better economic take-off.

We are not oblivious of Moody’s credit rating report which upgraded the country’s status, for which reason many investors became comfortable to do business with the government.

While celebrating this feat, it is important to note that we have travelled this path before, where investors showed a lot of interest in our economy, and yet, in the end, we retrogressed, only for us to pay a price for that unfortunate lapse. Eventually, we landed in the hands of the Breton Woods institutions to gain policy credibility and win the hearts of investors once again.

That route, no doubt, has been painful and the price we have paid is big enough to serve as a guide for us to desist from practices that take away our shine only for us to struggle to regain that international trust.

In an election year, there is the temptation to undertake projects for which we have not budgeted, and the history books, from the inception of the Fourth Republic, bear eloquent testimony to this fact.

It is our fervent hope that the sacrifices, the hard work and the confidence regained will not come to naught on political expediency.

The Daily Graphic believes that the managers of the economy will stay on track and do what is right for the country and not do anything for political expediency. The country has reached a stage where we cannot turn back and continue to rely on foreign resources to develop. Let us do things right and take our destiny into our own hands by properly utilising the funds raised, so that when we are called upon to pay back, we will not be found wanting. We also pray that the funds will be felt all around us and not evaporate into thin air.