West Africa central banks to fight currency counterfeiting

Central bankers in West Africa have expressed their commitment to collaborate to fight currency counterfeiting within the sub-region.

Advertisement

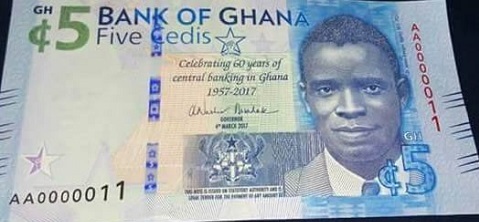

The growing menace affects almost all countries within the West Africa sub-region, with the scammers ready to pounce on any new currencies issued to flood the system with the fake versions at the expense of domestic economies.

At a capacity-building workshop on banknotes and currency management in Accra, the Director-General of the West African Institute for Financial and Economic Management (WAIFEM), Mr Akpan H. Ekpo, stressed the need for collaboration among financial institutions, central banks and law enforcement agencies to deal with the problem of counterfeits head-on.

He expressed the hope that the workshop would provide participants with the modern approach to currency management, trend in the practice, as well as maintain quality, durability and functionality of banknotes in circulation.

“It will also help participants to confront the counterfeiting threat and responses among other issues,” he said.

The workshop

Representatives from the various central banks in West Africa are participating in the 10-day capacity-building workshop organised by WAIFEM, an economic management training body set up by West African central banks.

Participants will treat and discuss issues such as the trending currency life cycle, features and benefits of paper currency, modern approach to currency management and trends in worldwide currency development.

Using Ghana as a case study, the participants will also delve into cash centre efficiency and optimisation.

Opening ceremony

In a statement read on his behalf, the Governor of the Bank of Ghana, Dr Abdul-Nashiru Issahaku, said currency management was a critical aspect of the function of central banks and underscored the importance of such capacity-building opportunities in the context, because all member countries operated cash-based economies.

Dr Issahaku submitted that cash-based economies reflected the preference of economic agents, the weaknesses of the legal system to enforce contracts and the low level of development of the payment systems in the participating countries, among other reflections.

“This workshop is important for us, given the problems of currency management and forecasting in most of our countries, and the need to chart a new direction consistent with best practices to ensure greater efficiency and minimise the cost of printing notes and minting coins,” he said.

Writer’s email [email protected]