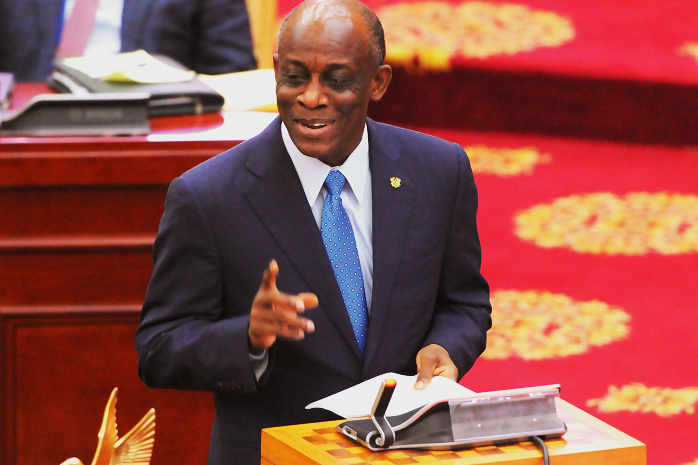

We’ll keep budget in check - Terkper

The Minister of Finance, Mr Seth Terkper, has assured the country that the government is resolved to resist budget overruns in this election year and will sustain fiscal discipline even as it invests prudently in infrastructure and social development.

Advertisement

Delivering his mid-year budget review and supplementary estimates for the 2016 financial year in Parliament yesterday, he said the fiscal deficit would be lowered again to five per cent of GDP this year, after a strong reduction to 6.3 per cent of GDP in 2015.

Although he requested Parliament to approve additional spending of almost GH¢1.9 billion by the government, his spending plans showed that the funds would be used to amortise government debts and so will not affect the net fiscal balance.

The new tighter fiscal deficit target is within the projections agreed under the current IMF programme and could likely assuage public and investor anxiety over whether the government will remain committed to controlling expenditure, given the upcoming elections.

“We remain committed to our resolve to resist budget overruns often associated with elections and managing the public debt towards ensuring debt sustainability. We are determined to sustain fiscal discipline while investing prudently in infrastructure and social development,” he said.

Revised estimates

On the basis of the revised revenue and estimates, Mr Terkper said the revised 2016 budget would result in an overall budget deficit of GH¢8,407.7 million (5.0 per cent of GDP), the same as the deficit of GH¢8,407.7 million (5.3 per cent of GDP) in the original 2016 budget.

“This will ensure that the pace of public debt accumulation remains the same as envisaged in the 2016 budget and in line with our debt sustainability objectives,” he said.

According to Mr Terkper, the revised budget deficit would be financed from foreign and domestic sources.

Foreign financing of the deficit is estimated at GH¢2,237.0 million, 34.2 per cent lower than the amount of net foreign financing projected in the 2016 budget.

“It is, however, important to note that the country expects to receive an additional programme loan of US$75 million from the World Bank and increased financing of about US$208 million from the IMF for budget support,” he said.

Fiscal position

Giving a breakdown of the fiscal position, the minister said the provisional data for the first five months of 2016 indicated that total revenue and grants and total expenditure, including the clearance of arrears, were both below their respective budget targets.

However, since the deviation in revenue from the budget target was significantly higher than expenditure for the period, it resulted in a cash fiscal deficit of 2.5 per cent of GDP, against a budget deficit target of 2.2 per cent.

This performance compares to a budget deficit of 2.2 per cent of GDP during the same period in 2015.

With the exception of taxes on domestic goods and services, all other tax types, as well as non-tax and grant disbursements, were below their respective budget targets.

Total tax revenue amounted to GH¢10,326.2 million and was 6.4 per cent below the budget target of GH¢11,032.8 million.

Revenue

Similarly, non-tax revenue fell below target by 22.5 per cent due to the non-realisation of non-tax oil revenue and gas receipts emanating from the significant decline in crude oil prices during this period.

In addition, not all anticipated dividends from state-owned agencies were realised.

Disbursement of grants from donor partners for the period was generally on track, only falling short of the budgeted target by 0.1 per cent.

Grants disbursed amounted to GH¢732.3 million, against a budget target of GH¢733 million.

Expenditure

Regarding expenditure, total expenditure, including arrears clearance, amounted to GH¢17,635.2 million, against a budget target of GH¢18,355.2 million.

Based on the revenue and expenditure performance, the fiscal balance on cash basis registered a deficit of GH¢4,178.7 million (2.5 per cent of GDP). It was slightly above the target of GH¢3,492.8 million (2.2 per cent of GDP) and compares to a deficit of GH¢3,077.5 million (2.2 per cent of GDP) during the same period in 2015.

The deficit of 2.5 per cent of GDP was financed mostly from domestic sources, amounting to GH¢4,307.5 million, while foreign financing constituted a net repayment of GH¢128.9 million.

The primary balance in the first five months of the year recorded a deficit of 0.1 per cent of GDP, against a targeted surplus of 0.4 per cent of GDP.

Public debt

On the public debt, he said provisional data showed that it reduced from 71.63 per cent of GDP at the end 2015 to 63.07 per cent at the end of May 2016.

Of the May 2016 public debt stock, domestic debt constituted 25.93 per cent of GDP, while external debt represented 37.14 per cent.

The rate of debt accumulation had significantly subsided with observance of ceilings on debt accumulation, exchange rate stability and increased nominal GDP, he said.

On a monthly basis, provisional January 2016 debt to GDP ratio stood at 60.64 per cent and rose to 63.07 per cent in May 2016, lower than the 68.53 per cent recorded in May 2015.