Amend Insurance Act, 2006 — Insurance Commissioner

The National Insurance Commission (NIC) has called for an amendment to the Insurance Act, 2006 (Act 724) to ensure that all government properties are insured.

Advertisement

Per the Insurance Act 2006, as it exists now, it is only compulsory that private commercial properties such as hospitals, schools, hotels, recreational centres, tour attractions and other facilities, have to be insured to protect human lives.

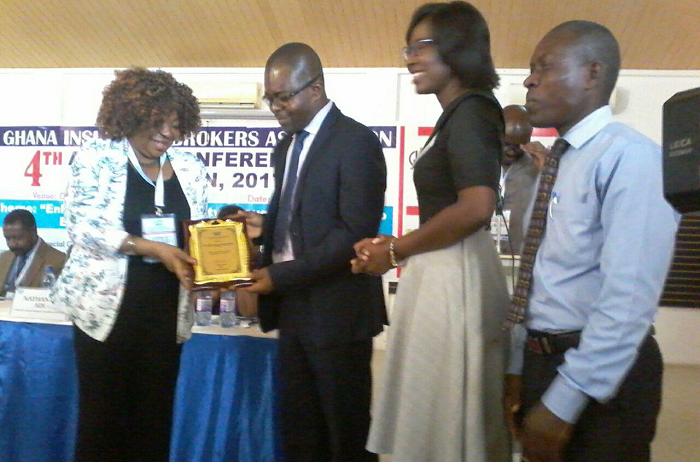

In an interview on the sidelines of the 4th Ghana Insurance Brokers Association (GIBA) conference in Ho, the Commissioner of Insurance, Ms Lydia Lariba Bawa, said the law must be amended to cover public properties to relieve the country of any liability in case of any eventuality.

She said the country had experienced national disasters, involving public assets, whereby the government had been required to pay huge compensations from the state coffers to victims.

She said because government properties were not insured, the state also tended to suffer incalculable losses in the event of any disaster or catastrophe.

Government shift liability

In the opinion of Ms Bawa, the responsibility should be shifted to insurance companies for them to pay whatever liability that would arise from any eventualities.

“We have had some fire outbreaks that have affected government properties like the Foreign Affairs building, the Central Medical Stores in Tema. We think that these are national assets which must be protected.

However, because they are not covered by any insurance, what happens is that the government will have to find money to reinstate or replace the loss, but if this responsibility is passed on to an insurance company, the company would take up the liability,” she said.

Using the incident that occurred at the Kintampo Waterfalls as an example, Ms Bawa said an insurance package could have been used to support victims instead of the government drawing money from its coffers to handle such disasters.

Earlier in her address at the conference which brought together 180 participants to deliberate on the theme: “Enhancing market capacity through commitment to effective collaboration and networking, ” Ms Bawa acknowledged the contributions of GIBA to creating a vibrant, resilient and flexible insurance industry.

She said the insurance industry significantly increased from total gross premiums of GH¢1 billion in 2013 to almost GH¢2 billion in 2016.

“The total life and non-life assets grew from GH¢1.7 billion to GH¢ 3.7 billion over the same period,” she said.

The commissioner mentioned that the implementation of risks based supervision by the NIC had helped to improve corporate governance and risk management culture within the industry.

NIC collaboration

Currently, the NIC, she said, was collaborating with the Ghana National Fire Service (GNFS) and the Ghana Police Service to enforce the compulsory fire insurance for private commercial buildings in accordance with the act, as well as the compulsory motor insurance under the Motor Vehicle Act.

In his welcome address, the President of GIBA, Mr Nathan Adu, appealed to the commissioner to renew the operating licence of GIBA Energy Company as it had met all the necessary requirements of the NIC.

He also said members should not limit collaboration among themselves only to the local market but “we should forge ahead and look at the regional and global collaborations as well so we can take bigger and tougher risks.”