Is your company paying dividend for 2016?

On May 17, shareholders of listed oil exploration and production company, Tullow Oil Ghana Limited, openly registered their resentment against the company’s inability to declare dividend for the 2016 financial year.

Advertisement

After missing out on dividends for the last two financial years, shareholders were expectant that Tullow Ghana, which produces the country’s two oilfields, would make up for the ‘losses they suffered’ by declaring and paying dividend on last year’s operations.

That expectation was, however, dashed when weak crude oil prices combined with other operational challenges to subdue revenues and, by extension, profit.

With capital expenditure on the rise and more investment needed to boost the company’s earning ability, the board did what most companies do at such times: discretionally withhold dividend payment, plough back the small profits and hope for rainy days in the coming years.

While that makes a lot of business sense, it is not what shareholders expect when buying stocks.

With dividend being one of the few gains that some investors on the stock market look up to, when venturing into it, holding a stock that does not pay dividend often can be frustrating.

This explains why most individual investors have disinvested from debt-ridden cocoa grinder, the Cocoa Processing Company (CPC).

After listing with euphoria on the Ghana Stock Exchange (GSE) in 2003, CPC’s fortunes have been on the decline, owning to rising cost, mismanagement and remnants of three separate loan facilities that the company took to help expand its operations.

As a result, it has not paid dividend for the past 10 years, prompting most of its shareholders to openly register their resentments at meetings.

Although the company is yet to hold its 2016 annual general meeting, it is needless to say that there will equally not be dividend this year and only time can tell how shareholders will react.

2016 Dividend

Tullow and CPC are not the only companies not paying dividend on last year’s operations.

Indigenous bank, CAL Bank, is one of them. After significant impairments pressed down its profits to GH¢7.2 in 2016 from GH¢160 million in 2015, the bank’s board relegated dividend to the back-burner, with the hope that “2017 will turn out a better year” for CAL Bank “to return to the era of consistent dividend payment”.

That assurance is soothing, says 81-year-old Mr Sas George, who is a veteran investor on the local bourse.

“Generally, most of the banks could not declare dividend this year because of the impairment or bad debt,” he said, referring to the rise in the non-performing loan ratio to 17.4 per cent in December, last year.

“We hope that those people (whose loans have been impaired) will pay the money so that the banks can turn around and be able to pay dividend,” he said.

Of the nine banks listed on the GSE, only four have so far declared dividend. And apart from new entrant – ADB – whose financial results are yet to be published, those remaining have registered losses, with CAL Bank’s being the highest.

Plough-back vs dividend

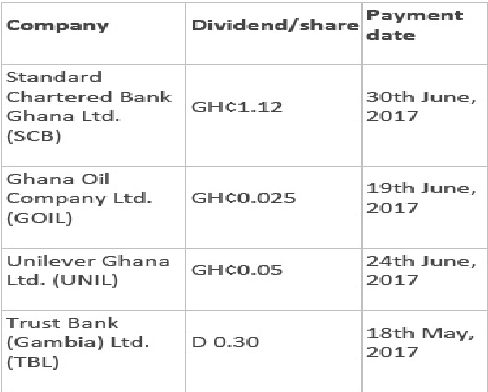

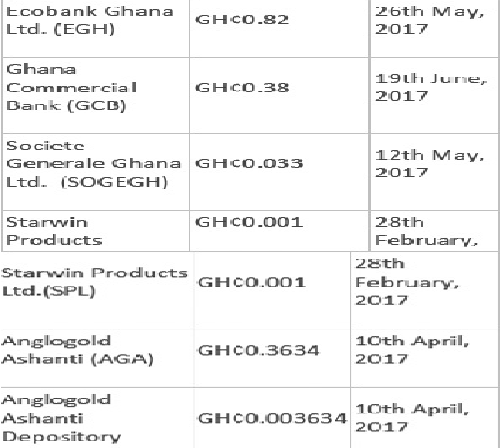

As of May 1, 10 stocks out of the 37 on the GSE had declared dividend on their 2016 operations.

Although some of the listings are still announcing their decisions, the impact of last year’s fiscal constraints on businesses shows dividend payment will be lower this year compared to the previous years.

This is not necessarily a sign that the companies are doing poorly, Head of Research at FirstBanC Financial Services, Mr Ben Amoah-Adjei, said.

In the banking sector for instance, the situation is compounded by ongoing attempts by the Bank of Ghana to recapitalise the banks.

The recapitalisation means that most banks will prefer to hold on to their liquid cash and use it to recapitalise rather than using it to pay dividend and later having to seek help from external sources.

In doing that, however, listed companies will have to weigh the impact of their decisions on dividend on the general well-being of the company and the share price in particular.

While dividend payment may not be a complete sign of a company’s sound finances, it helps in stabilising the stock price and that helps to endear it to investors.

Like Mr Amoah-Adjei said, some shareholders who need steady flow of income from their investments “are always a little upset when companies refuse to pay dividend.”