Housing and mortgage insurance

Life expectancy among Ghanaians is said to have increased to 61.0 for males and 63.1 for females (WHO data-2015). Much as this sounds refreshing to know, this does not necessarily suggest that not many working persons are dying much younger than expected.

Advertisement

As this may affect the demand for some forms of insurance, it does not take away the facts that the risk management mechanisms of especially lending institutions should be taken for granted. This even calls for a tighter adherence to ensure that such lending institutions remain firmly in business as life goes on!

Owning a House

Owning a home is one of man’s biggest desires, but only a few people are able to acquire their own. With the ever growing middle class in our society [who are particularly minded about their independence and the need to build a successful family], owning a house through mortgage from financial institutions (e.g., commercial banks) is now gaining popularity in Ghana. Indeed, it is one of the safest ways to acquire a house, considering the many land litigation's often associated with building a house on one’s own.

But most of these commercial banks or lending institutions, typically require mortgage insurance as a prerequisite for granting a mortgage facility. Because such facilities often span between 10-35 years – which may be the entire working life of the borrower, it is associated with a number of risks (e.g., borrowers’ death, incapacitation or job loss). A typical example is having a family ejected from their homes after their breadwinners fail to continue to repay their mortgage facilities as a result of job loss, death or incapacitation. These associated risks ,therefore, birthed the need for mortgage insurance.

Mortgage Insurance (MI)

MI, also referred to as mortgage guarantee, home-loan insurance or mortgage indemnity guarantee, is an insurance policy that provides compensation to lending institutions for losses arising from the default of a mortgage loan. MI may be public or private depending on the particular insurer. Typically, MI reimburses the lending institution in the event of default. The borrower pays the premium, often referred to as Private Mortgage Insurance (PMI), but these premiums may vary depending on the advance payment.

History of Mortgage Insurance

Though Mortgage insurance began in the United States in the 1880s, the federal government began insuring mortgages in 1934 through the Federal Housing Administration and Veteran's Administration, but after the Great Depression, no private mortgage insurance was authorised in the United States until 1956 when Wisconsin passed a law allowing the first post-Depression insurer, Mortgage Guaranty Insurance Corporation to be chartered. In 1999, the Homeowners Protection Act of 1998 effectively became a federal law of the United States which requires automatic termination of MI in certain cases for homeowners when the loan-to-value on the home reaches 78 per cent (Wikipedia, July 20, 2015).

How MI works

Just like any other forms of insurance transaction, in mortgage insurance, a policy document is issued to a lending institution, a commercial bank or other mortgage-holding entity, detailing the terms and conditions of the coverage.

The policy document often contains client-specific information and general conditions such as exclusions (e.g., suicide clauses), conditions for notification of loans in default and claims settlement. Depending on the mortgage value, however, some insurance underwriters may require a medical report of the borrower.

Meanwhile, the exclusion clauses sometimes have ‘incontestability provisions’ which limit the ability of the mortgage insurer to deny coverage for misrepresentations attributed to the policyholder, if 12 consecutive payments are made. But these incontestability provisions, generally, don't apply to fraud.

Jurisdictional differences

Notwithstanding that, MI operates differently in different countries, the indemnity principle remains the same. For instance, whereas in Australia borrowers pay over 80 per cent of the purchase price for Lenders Mortgage Insurance (LMI) for home loans, in Singapore, it is mandatory for flats owners to have a mortgage insurance if they are using the balance in their Provident Fund accounts to pay for the monthly mortgage installment.

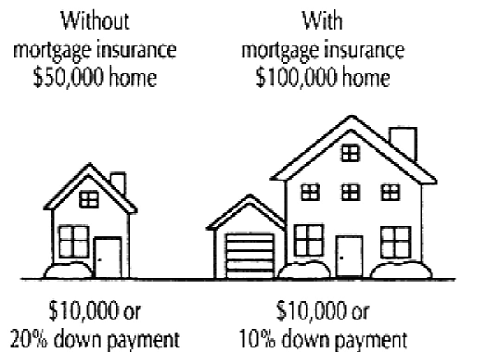

It is ,however, optional for owners of private homes in Singapore to take mortgage insurance. Meanwhile, in the United States, private mortgage insurance is typically required when down payments are below 20 per cent.

Rating

Essentially, factors such as the value of the loan insured, loan-to-value (LTV) or the proposer’s credit profile are often taken into consideration when rating a mortgage risk. Rates can range from 0.32 per cent to 1.20 per cent of the principal loan amount and premiums may be paid in a single lump sum, annually, monthly, or a combination of the two.

Types of MI

The nature of a mortgage policy will largely depend on who is taking the policy; i.e., the borrower or the lender.

• Borrower-Paid Private Mortgage Insurance (BPMI)

BPMI or "Traditional Mortgage Insurance" is default insurance on mortgage loans provided by insurers and paid for by borrowers. BPMI allows borrowers to obtain a mortgage without having to provide 20 per cent down payment, by covering the lender for the added risk of a high loan-to-value (LTV) mortgage.

• Lender-Paid Private Mortgage Insurance (LPMI)

LPMI is similar to BPMI except that it is paid for by the lender, and the borrower is often unaware of its existence. LPMI is usually a feature of loans do not require Mortgage Insurance for high LTV loans. The cost of the premium is however, built into the interest rate charged on the loan.

MI in Ghana

Though underwriting MI in Ghana started many years ago, its current high demand is partly due to the developments in the estate industry which is helping to address the housing deficiency in Ghana.

Indeed, there is a growing interest among the working class to acquire homes through mortgage facilities from various financial institutions. This ,therefore, calls for prudence in underwriting the associated risks.

Challenges

In all of this, the quest to circumvent the underwriting processes by some unscrupulous borrowers may have to be contended with, as some would-be borrowers may want to conceal their deteriorating health statuses in order to exploit the processes.

It must, however, be emphasized that providing appropriate health and other personal details helps in the determination of appropriate premiums at inception.

Claims payment

For MI claims to be processed, there must be adequate proof of loss or events leading to that. For example, in the event of death, a medical cause of death may be required. Though claims may be declined on the basis of misrepresentation, the Central District of California court in 2009 held that mortgage insurance could not be repudiated en bloc.

The way forward

Lending institutions must continue to insist on MI for all mortgage facilities as it provides them, the borrowers and the business community at large, peace of mind. Borrowers must also endeavour to always provide accurate personal information in order to avoid disappointments in the event of claims.