Capital budgeting decisions (Part five)

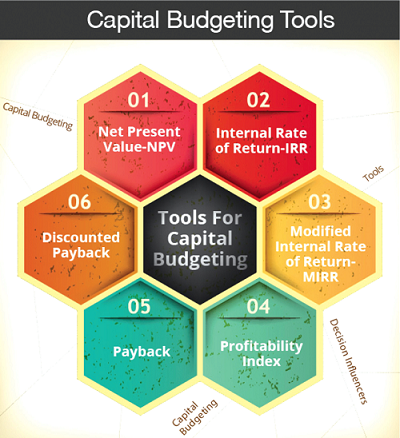

This write-up is a continuation of earlier publications on how managers could effectively strategise and manage complex investment decisions to ensure profitability of their respective firms. Discussions in the previous feature ended on some capital budgeting methods.

Advertisement

Internal Rate of Return (IRR)

The appropriate interest rate that compels the net present value of a project to equal zero is called the internal rate of return (IRR). It is the interest rate that ensures equilibrium between the present value of future cash inflows and outflows, and the initial investment capital of a project. The internal rate of return shows the value, in percentage terms, that investment projects return to the company. The computation of the IRR is not different from the process of determining the yield to maturity (YTM) on bonds. The internal rate of return is determined by the following equation.

Where:

CF = The project’s cash flow

I0 = Initial investment outlay

IRR = Internal rate of return

NPV = Net present value

n = Life of the project

Although all the values for the project’s initial capital outlay (I0) and cash flows (CF1, CF2, CF3 ...CFn) are readily known, we do not know the value of the internal rate of return. Thus, we have a mathematical equation with one unknown, and we have to solve for the internal rate of return. We need to find the discounted rate that would allow the NPV and the equation to equal zero. It is easy for us to compute the NPV of the projects without financial calculators. However, the same cannot be said about the IRR. Without a financial calculator, the IRR could be determined through trial and error. But Brigham and Ehrhardt (2008) believe the trial and error method could be very tedious and time-consuming when applied to real projects with extended lives.

Table 5: Computation of IRR for Project E

Year Cash Flow PVF@10% PVF@20% PVF@22% [email protected]%

0 $(1,500) 1.000 $(1,500.00) 1.000 $(1,500.00) 1.000 $(1,500.00) 1.000 $(1,500.00)

1 150 0.909 136.35 0.833 124.95 0.820 123.00 0.814 122.10

2 300 0.826 247.80 0.694 208.20 0.672 201.00 0.662 198.60

3 450 0.751 337.95 0.579 260.55 0.551 247.95 0.540 243.00

4 600 0.683 409.80 0.482 289.20 0.451 270.60 0.438 262.80

5 1,875 0.621 1,164.38 0.402 753.75 0.370 693.75 0.360 675.00

$ 1,875 $ 796.28 $ 136.65 $ 36.90 $ 1.50

However, it is refreshing to note that the internal rate of return for a project can be determined using financial calculators and Excel (Spreadsheet) found in computers. An important observation here is the mathematical derivation of the IRR, Equation 14, is the same as the net present value formula, Equation 13, which we used in calculating the value of k that compels the net present value to equal zero. Thus, both the NPV and IRR employ the same basic equation, but in the case of the NPV formula, the discount rate, k, is specified as the cost of capital or hurdle rate determined by the market, and the NPV is computed whereas in the case of the IRR formula, the NPV is set to equal zero and the rate which ensures the NPV equals zero is determined.

The figures in Table 5 depict the calculations for the internal rate of return of Project E. The IRR for Project E is determined through trial and error. For project E, the discount rate that compels the NPV to equal zero is 22.9 per cent, when the discount rate is zero. Project E’s net present value equals $1,875. A discount rate of zero implies time value of money is nonexistent. In this case, net present value equals the total cash flows of a project. The project’s net present value equals its current cash flow, $(1,500), when the discount rate is infinite. Generally, the discount rate that forces the net present value to be equal to zero is located between the two foregoing positions - a zero discount rate and an infinite discount rate. The four projects record the internal rates of return listed below:

• Project E, IRR = 22.9%

• Project F, IRR = 25.4%

• Project G, IRR = (200.0%)

• Project H, IRR = 20.9%

The principle underlying the internal rate of return indicates the firm should accept a project with an IRR greater than the opportunity cost of capital (k), when the projects are independent; it should accept the project with the highest IRR when the projects are mutually exclusive. The presupposition here is, the firm would accept Projects E, F, and H if the projects are independent. Suppose the four projects are mutually exclusive. The firm would choose Project F (and reject the rest) because it promises the highest IRR. If the opportunity cost of funds is more than 25.4 per cent, all the projects should not be accepted.

The NPV Method versus IRR Method

A comparison of the NPV and IRR methods reveals both share some similarities and differences in their approach to project valuation. For instance, both methods recognize the significance of discount rate in the determination of the value of a project. Under the NPV method, the firm would accept an independent project with a net present value greater than zero; and the firm would accept a mutually exclusive project with the highest net present value. The mathematical equation used in this process is under the IRR method, we solve for the internal rate of return that compels the net present value to equal zero, as illustrated in Equation 10.

As noted earlier, the IRR accepts a mutually exclusive project with the highest internal rate of return; it also accepts all independent projects with an internal rate of return above the opportunity cost of funds. When the internal rate of return equals the opportunity cost of capital, the net present value equals zero; when the net present value is greater than zero, the internal rate of return is greater than the cost of capital. And when the net present value is less than zero, the internal rate of return is less than the cost of capital. At a cost of capital of 10 per cent, the cash flows from Project S illustrated in Table 6 show a negative NPV of $(97.40). Under the NPV principle, the project must not be accepted. An evaluation of the same project under the internal rate of return method shows the IRR for the project is 4.5 per cent.

Table 6:

Present Values at 10% Discount Rate for Project S

Year Cash Flow Present Value @ 10%

1 $(1,200) 0.909 $(1,090.00)

2 500 0.826 413.00

3 500 0.751 375.50

4 300 0.683 204.90

NPV $ 97.40

Since the project’s IRR (4.5%) is less than its cost of capital (10%), it would be rejected under the internal rate of return rule. This result confirms Weston and Copeland’s (1992) argument that when the net present value is less than zero, the internal rate of return is less than the cost of capital, and that management would approve of projects with IRRs greater than the opportunity cost of initial capital outlay. The NPV technique differs from the IRR technique in that the rejection of a project under the former does not mean, necessarily, that it would be rejected under the latter, vice versa. To illustrate, suppose the NPV of a project with a discount rate of 10 per cent and estimated life of four years is $(30.50), and the IRR of the same project is 18.2 per cent. The NPV rule requires us to reject the project. However, the IRR rule encourages us to accept the project because IRR >k. The difference between the NPV and IRR techniques is also identified in their selection of projects, as shown is Table 7. The IRR technique identifies Project F as the best among the alternatives.

However, the firm would have to channel its financial resources into Project E if the NPV method is employed; this is the project that is most likely to maximize the wealth of shareholders. Clearly, each of the four methods (ARR, Payback, NPV, and IRR) in Table 7 accepts a different project. While the NPV and IRR favor Projects E and F, the ARR and Payback favor Projects H and G respectively. As indicated earlier, we reject the ARR and Payback methods because they do not discount cash flows from the projects.

Table 7:

Selection of Mutually Exclusive Projects under Different Evaluation Techniques

Method Project E Project F Project G Project H

ARR 25% 22% -8% 26%

Payback 4 years 3 years 2 years 4 years

NPV $796.28 $778.80 $(610.95) $766.05

IRR 22.9% 25.4% (200%) 20.9%

Most managers prefer to determine the value of returns on projects using percentages rather than monetary figures because it allows them to compare returns with the cost of financing projects. As a result, they consider the IRR as the best means of evaluating and accepting projects compared with the NPV.

However, most financial experts, including Brigham and Ehrhardt (2008), Copeland and Weston (1983), and Weston and Copeland (1992) believe the IRR is not the ideal method because it does not explicitly take the time value of money into account; it does not effectively consider the cost of capital; it does not adhere to the value additivity principle; and because it could lead firms into recording many internal rates of return for the same project, if the estimated cash flows tend to be inconsistent. These weaknesses further entrench the stance of financial experts who opine the NPV is the best capital budgeting technique that could adequately ensure the maximisation of shareowners’ wealth. This argument notwithstanding, findings from the research conducted by Gitman and Forrester (1997), and Kim, Crick, and Kim (1986) revealed more companies implement the IRR method than the NPV method.