Steady but slow: Resilience amid divergence

The global economy remains remarkably resilient, with growth holding steady as inflation returns to target.

Advertisement

The journey has been eventful, starting with supply-chain disruptions in the aftermath of the pandemic, a Russian-initiated war on Ukraine that triggered a global energy and food crisis, and a considerable surge in inflation, followed by a globally synchronized monetary policy tightening.

Yet, despite many gloomy predictions, the world avoided a recession, the banking system proved largely resilient, and major emerging market economies did not suffer sudden stops. Moreover, the inflation surge—despite its severity and the associated cost-of living crisis—did not trigger uncontrolled wage-price spirals (see October

2022 World Economic Outlook).

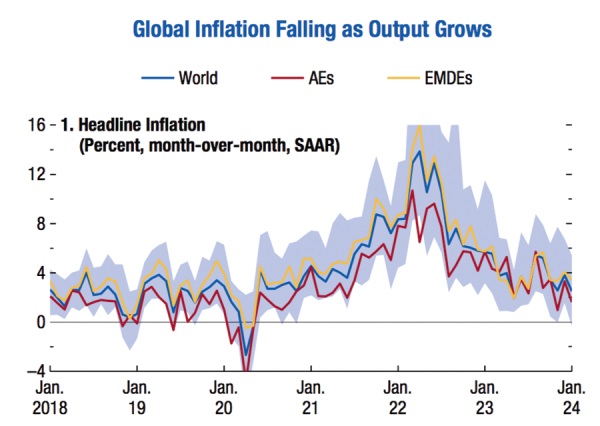

Instead, almost as quickly as global inflation went up, it has been coming down. On a year-over-year basis, global growth bottomed out at the end of 2022, at 2.3 percent, shortly after median headline inflation peaked at 9.4 percent.

According to our latest projections, growth for 2024 and 2025 will hold steady around 3.2 percent, with median headline inflation declining from 2.8 percent at the end of 2024 to 2.4 percent at the end of 2025. Most indicators point to a soft landing.

Markets reacted exuberantly to the prospect of central banks exiting from tight monetary policy. Financial conditions eased, equity valuations soared, capital flows to most emerging market economies excluding China have been buoyant, and some low-income countries and frontier economies regained market access (see the April 2024 Global Financial Stability Report).

Less economic scarring

Even more encouraging, we now estimate that there will be less economic scarring from the pandemic—the projected drop in output relative to pre pandemic projections—for most countries and regions, especially for emerging market economies, thanks in part to robust employment growth.

Astonishingly, the US economy has already surged past its pre pandemic trend. Resilient growth and faster disinflation point toward favorable supply developments, including the fading of earlier energy price shocks, the striking rebound in labor supply supported by strong immigration flows in many advanced economies.

Decisive monetary policy actions, as well as improved monetary policy frameworks, especially in emerging market economies, have helped anchor inflation expectations.

As Chapter 2 of this report argues, however, the transmission of monetary policy may have been more muted this time around in countries such as the United States, where an increased share of fixed-rate mortgages and lower household debt levels since the global financial crisis may have limited the drag on aggregate demand up to now.

Despite these welcome developments, numerous challenges remain, and decisive actions are needed. First, while inflation trends are encouraging, we are not there yet.

Somewhat worryingly, the most recent median headline and core inflation numbers are pushing upward.

This could be temporary, but there are reasons to remain vigilant. Most of the progress on inflation came from the decline in energy prices and goods inflation below its historical average. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But services inflation remains high—sometimes stubbornly so—and could derail the disinflation path. Bringing inflation down to target remains the priority.

Stark divergence

Second, the global view can mask stark divergence across countries. The exceptional recent performance of the United States is certainly impressive and a major driver of global growth, but it reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability (see April 2024 Fiscal Monitor).

This raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy since it risks pushing up global funding costs. Something will have to give.

In the euro area, growth will pick up this year, but from very low levels, as the trailing effects of tight International Monetary Fund | April 2024 monetary policy and past energy costs, as well as planned fiscal consolidation, weigh on activity.

Continued high wage growth and persistent services inflation could delay the return of inflation to target. However, unlike in the United States, there is scant evidence of overheating and the European Central Bank will also need to carefully calibrate the pivot toward monetary easing to avoid an excessive growth slowdown and inflation undershoot.

While labor markets appear strong, that strength could prove illusory if European firms have been hoarding labor in anticipation of a pickup in activity that does not materialize. China’s economy is affected by the enduring downturn in its property sector.

Credit booms and busts never resolve themselves quickly, and this one is no exception. Domestic demand will remain lackluster for some time unless strong measures and reforms address the root cause.

Public debt

Public debt dynamics are also of concern, especially if the property crisis morphs into a local public finance crisis. With depressed domestic demand, external surpluses could rise. The risk is that this will further exacerbate trade tensions in an already fraught geopolitical environment.

At the same time, many other large emerging market economies are performing strongly, sometimes even benefiting from a reconfiguration of global supply chains and rising trade tensions between China and the United States.

As Chapter 4 of this report documents, these countries’ footprint on the global economy is increasing, and they will play an ever larger role in supporting global growth in years to come. A troubling development is the widening divergence between many low-income developing countries and the rest of the world.

For these economies, growth is revised downward, whereas inflation is revised up. Worse, in contrast with most other regions, scarring estimates for low-income developing countries, including some large ones, have been revised up, suggesting that the poorest countries are still unable to turn the page from the pandemic and cost-of-living crises.

In addition, conflicts continue to result in loss of human lives and raise uncertainty. For these countries, investing in structural reforms to promote growth-enhancing domestic and foreign direct investment, and strengthening domestic resource mobilization, can help manage borrowing costs and reduce funding needs while achieving development goals.

Efforts must also be made to improve the human capital of their large young populations.

Third, even as inflation recedes, real interest rates have increased, and sovereign debt dynamics have become less favorable in particular for highly indebted emerging markets. Countries should turn their sights toward rebuilding fiscal buffers.

Fiscal consolidation

Credible fiscal consolidations help lower funding costs and improve financial stability. In a world with more frequent adverse supply shocks and growing fiscal needs for safety nets, climate adaptation, digital transformation, energy security, and defense, this should be a policy priority.

Yet this is never easy, as the April 2023 World Economic Outlook documented: fiscal consolidations are more likely to succeed when credible and when implemented while the economy is growing, rather than when markets dictate their conditions.

In countries where inflation is under control, and that engage in a credible multiyear effort to rebuild fiscal buffers, monetary policy can help support activity. The successful 1993 US fiscal consolidation and monetary accommodation episode comes to mind as an example to emulate.

Fourth, medium-term growth prospects remain historically weak. Chapter 3 of this report takes an in-depth dive into the different drivers of the slowdown. The main culprit is lower total factor productivity growth.

A significant part of the decline comes from increased misallocation of capital and labor within sectors and countries. Facilitating faster and more efficient resource allocation can help boost growth. Much hope rests on artificial intelligence (AI) delivering strong productivity gains in the medium term.

It may do so, but the potential for serious disruptions in labor and financial markets is high. Harnessing the potential of AI for all will require that countries improve their digital infrastructure, invest in human capital, and coordinate on global rules of the road.

Medium-term growth prospects are also harmed by rising geoeconomic fragmentation and the surge in trade restrictive and industrial policy measures since 2019. Global trade linkages are already changing as a result, with potential losses in efficiency.

But the broader damage is to global cooperation and multilateralism. Finally, huge global investments are needed for a green and climate-resilient future. Cutting emissions is compatible with growth, as is seen in recent decades during which growth has become much less emissions intensive.

Nevertheless, emissions are still rising. A lot more needs to be done and done quickly. Green investment has expanded at a healthy pace in advanced FOREWORD International Monetary Fund | April 2024 xv economies and China.

Cutting harmful fossil fuel subsidies can help create the necessary fiscal room for further green investments. The greatest effort must be made by other emerging market and developing economies, which need to massively increase their green investment growth and reduce their fossil fuel investment.

This will require technology transfer by other advanced economies and China, as well as substantial financing, much of it from the private sector, but some of it concessional. On these questions, as well as on so many others, there is little hope for progress outside multilateral frameworks and cooperation